Summary

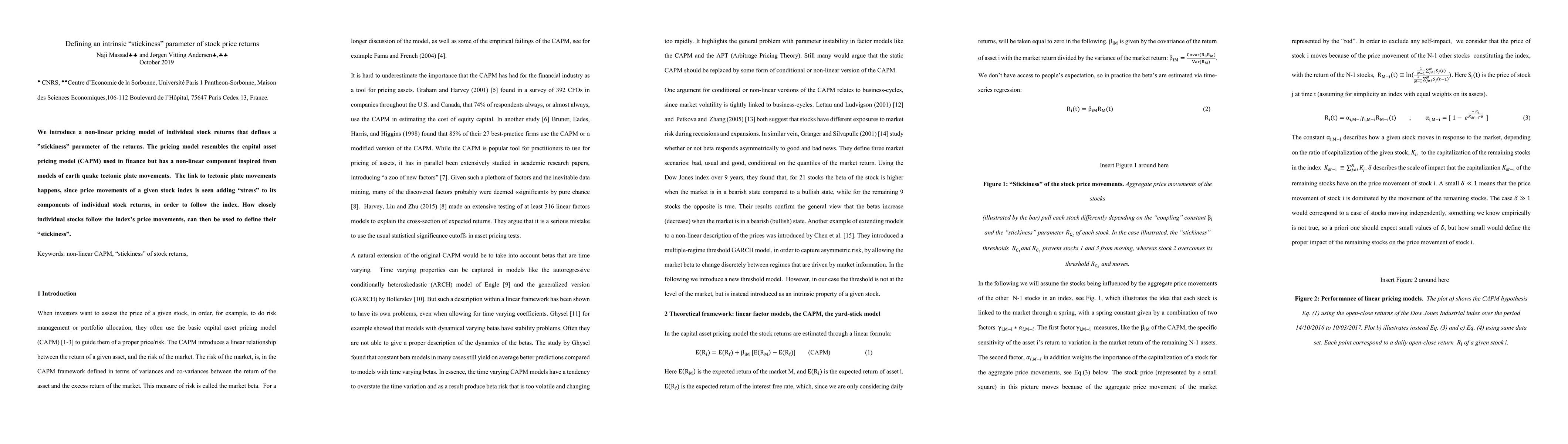

We introduce a non linear pricing model of individual stock returns that defines a stickiness parameter of the returns. The pricing model resembles the capital asset pricing model used in finance but has a non linear component inspired from models of earth quake tectonic plate movements. The link to tectonic plate movements happens, since price movements of a given stock index is seen adding stress to its components of individual stock returns, in order to follow the index. How closely individual stocks follow the indexs price movements, can then be used to define their stickiness

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)