Authors

Summary

Covariance matrices estimated from short, noisy, and non-Gaussian financial time series-particularly cryptocurrencies-are notoriously unstable. Empirical evidence indicates that these covariance structures often exhibit power-law scaling, reflecting complex and hierarchical interactions among assets. Building on this insight, we propose a power-law covariance model to characterize the collective dynamics of cryptocurrencies and develop a hybrid estimator that integrates Random Matrix Theory (RMT) with Residual Neural Networks (ResNets). The RMT component regularizes the eigenvalue spectrum under high-dimensional noise, while the ResNet learns data-driven corrections to recover latent structural dependencies. Monte Carlo simulations show that ResNet-based estimators consistently minimize both Frobenius and minimum-variance (MV) losses across diverse covariance models. Empirical experiments on 89 cryptocurrencies (2020-2025), using a training period ending at the local BTC maximum in November 2021 and testing through the subsequent bear market, demonstrate that a two-step estimator combining hierarchical filtering with ResNet corrections yields the most profitable and balanced portfolios, remaining robust under market regime shifts. These findings highlight the potential of combining RMT, deep learning, and power-law modeling to capture the intrinsic complexity of financial systems and enhance portfolio optimization under realistic conditions.

AI Key Findings

Generated Oct 24, 2025

Methodology

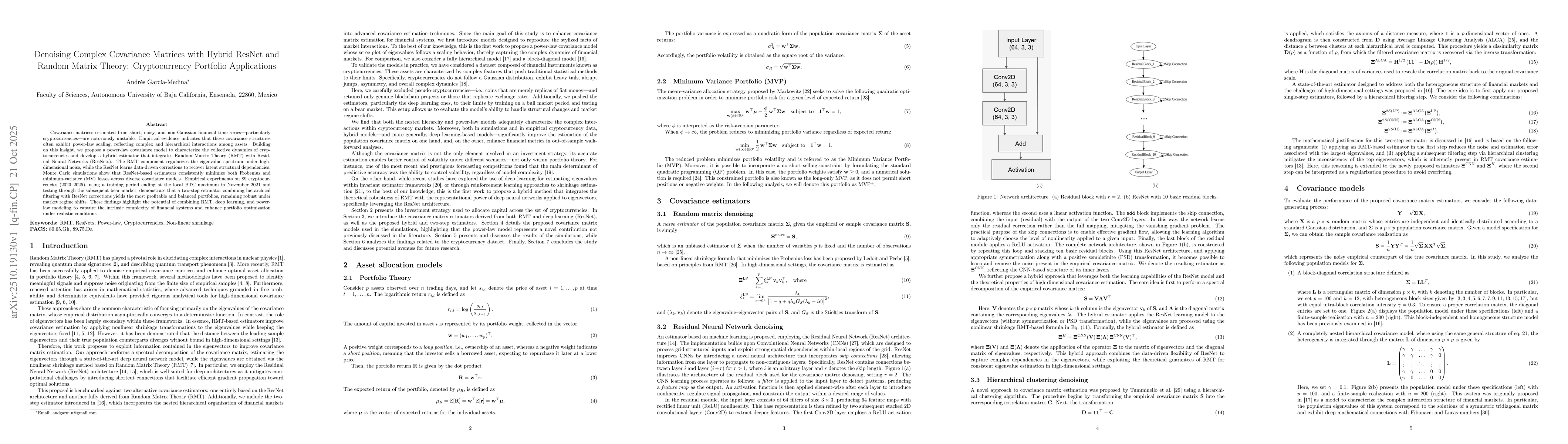

The paper combines Random Matrix Theory (RMT) with Residual Neural Networks (ResNets) to denoise complex covariance matrices. It uses Monte Carlo simulations and empirical analysis on cryptocurrency data to evaluate performance.

Key Results

- The two-step estimator combining hierarchical filtering with ResNet corrections yields the most profitable and balanced portfolios

- ResNet-based estimators minimize both Frobenius and minimum-variance losses across diverse covariance models

- The power-law covariance model effectively captures the complex interactions in cryptocurrency markets

Significance

This research enhances portfolio optimization under realistic financial conditions by integrating RMT, deep learning, and power-law modeling to handle noisy, non-Gaussian financial data.

Technical Contribution

Development of a hybrid estimator that integrates RMT for eigenvalue regularization with ResNets for data-driven corrections to covariance matrices

Novelty

First formulation of a power-law covariance matrix model as a representation of financial interactions, combined with deep learning for noise suppression in high-dimensional financial data

Limitations

- The naive estimator performs poorly in terms of MV loss but reasonably in F loss

- The hybrid estimators show limited improvement over naive for power-law models

- The study focuses on cryptocurrency markets which may not generalize to other financial assets

Future Work

- Integrate asset selection and fundamental analysis into covariance estimation frameworks

- Explore hybrid models combining RMT with other deep learning architectures

- Investigate the impact of market regime shifts on portfolio performance

Comments (0)