Summary

Credit card fraud is a major issue nowadays, costing huge money and affecting trust in financial systems. Traditional fraud detection methods often fail to detect advanced and growing fraud techniques. This study focuses on using Graph Neural Networks (GNNs) to improve fraud detection by analyzing transactions as a network of connected data points, such as accounts, traders, and devices. The proposed "detectGNN" model uses advanced features like time-based patterns and dynamic updates to expose hidden fraud and improve detection accuracy. Tests show that GNNs perform better than traditional methods in finding complex and multi-layered fraud. The model also addresses real-time processing, data imbalance, and privacy concerns, making it practical for real-world use. This research shows that GNNs can provide a powerful, accurate, and a scalable solution for detecting fraud. Future work will focus on making the models easier to understand, privacy-friendly, and adaptable to new types of fraud, ensuring safer financial transactions in the digital world.

AI Key Findings

Generated Jun 11, 2025

Methodology

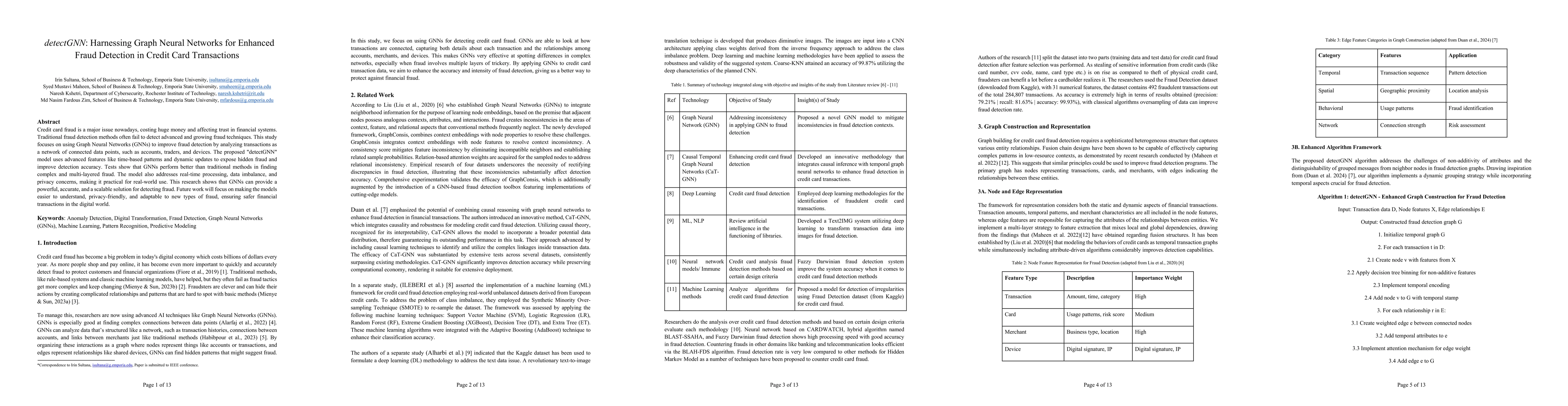

The research proposes 'detectGNN', a Graph Neural Network (GNN) model for credit card fraud detection, utilizing temporal patterns and dynamic updates to improve accuracy in identifying complex fraud schemes. It employs a hierarchical graph construction method, temporal encoding, decision tree binning, attention mechanisms, and dynamic graph updates.

Key Results

- GNNs outperform traditional fraud detection methods in identifying complex and multi-layered fraud.

- The model effectively handles real-time processing, data imbalance, and privacy concerns, making it suitable for real-world applications.

- Feature engineering optimization, combining traditional transaction attributes with graph-based features, significantly improves detection accuracy.

- A two-stage directed graph technique in the system architecture, integrating GNNs and XGBoost, enhances accuracy and explainability in fraud detection.

Significance

This research demonstrates that GNNs provide a powerful, accurate, and scalable solution for detecting fraud in credit card transactions, addressing critical issues such as data imbalance, real-time processing, and privacy concerns, which are often unresolved by traditional methods.

Technical Contribution

The paper introduces 'detectGNN', an enhanced algorithm framework for constructing fraud detection graphs using GNNs, incorporating temporal aspects, dynamic grouping strategies, and attention mechanisms to improve fraud detection accuracy.

Novelty

The research distinguishes itself by applying GNNs to credit card fraud detection, addressing challenges like data imbalance, real-time processing, and privacy concerns, and providing a comprehensive implementation framework using the Deep Graph Library (DGL).

Limitations

- GNNs can be challenging to interpret, which may hinder regulatory compliance and trust in their decisions.

- High computational power requirements might pose a barrier for widespread adoption, especially for smaller financial institutions.

Future Work

- Focus on making GNN models more interpretable to enhance regulatory adherence and trust.

- Explore integration with other deep learning methodologies to create more robust multimodal fraud detection systems.

- Investigate techniques to address class imbalance in fraud detection datasets for improved GNN performance.

- Enhance scalability and computational efficiency of GNN models for real-time processing of extensive transaction data.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDetecting Credit Card Fraud via Heterogeneous Graph Neural Networks with Graph Attention

Jie Liu, Yixian Wang, Xinyu Du et al.

CaT-GNN: Enhancing Credit Card Fraud Detection via Causal Temporal Graph Neural Networks

Xinke Jiang, Hao Wu, Yifan Duan et al.

Enhancing Credit Card Fraud Detection A Neural Network and SMOTE Integrated Approach

Ye Zhang, Yulu Gong, Mengran Zhu et al.

No citations found for this paper.

Comments (0)