Authors

Summary

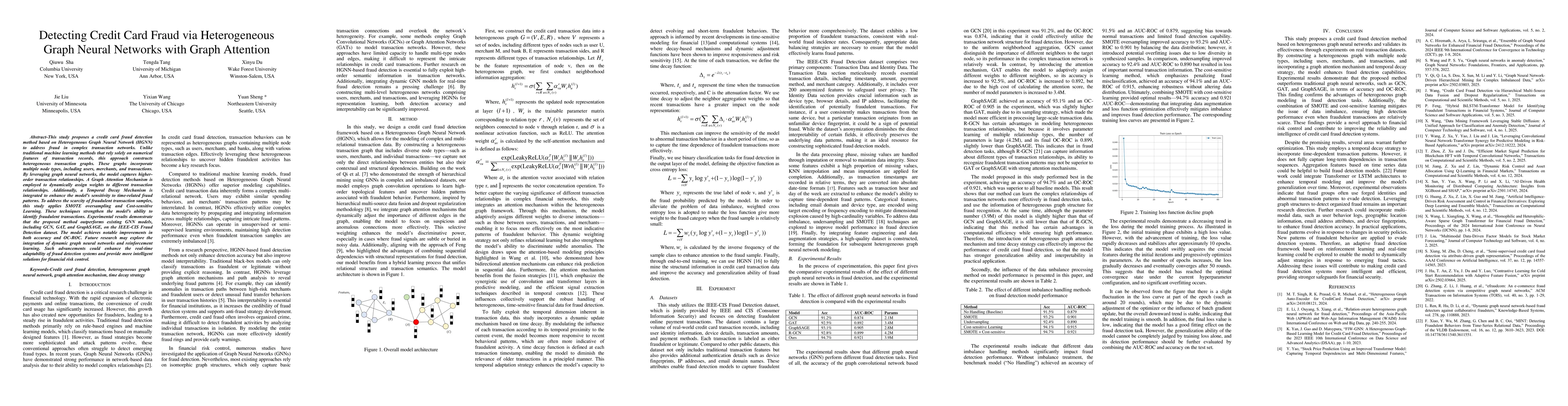

This study proposes a credit card fraud detection method based on Heterogeneous Graph Neural Network (HGNN) to address fraud in complex transaction networks. Unlike traditional machine learning methods that rely solely on numerical features of transaction records, this approach constructs heterogeneous transaction graphs. These graphs incorporate multiple node types, including users, merchants, and transactions. By leveraging graph neural networks, the model captures higher-order transaction relationships. A Graph Attention Mechanism is employed to dynamically assign weights to different transaction relationships. Additionally, a Temporal Decay Mechanism is integrated to enhance the model's sensitivity to time-related fraud patterns. To address the scarcity of fraudulent transaction samples, this study applies SMOTE oversampling and Cost-sensitive Learning. These techniques strengthen the model's ability to identify fraudulent transactions. Experimental results demonstrate that the proposed method outperforms existing GNN models, including GCN, GAT, and GraphSAGE, on the IEEE-CIS Fraud Detection dataset. The model achieves notable improvements in both accuracy and OC-ROC. Future research may explore the integration of dynamic graph neural networks and reinforcement learning. Such advancements could enhance the real-time adaptability of fraud detection systems and provide more intelligent solutions for financial risk control.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study proposes a credit card fraud detection method using Heterogeneous Graph Neural Networks (HGNN) that models complex transaction networks with multiple node types (users, merchants, transactions) and captures higher-order relationships via graph convolution and attention mechanisms, including a temporal decay mechanism to focus on recent behavioral patterns.

Key Results

- The proposed method outperforms existing GNN models (GCN, GAT, GraphSAGE) on the IEEE-CIS Fraud Detection dataset in terms of accuracy and OC-ROC.

- Integration of SMOTE oversampling and cost-sensitive learning enhances the model's ability to identify fraudulent transactions, especially when dealing with imbalanced datasets.

- The model demonstrates notable improvements in both accuracy (94.7%) and OC-ROC (0.921) compared to baseline models.

Significance

This research contributes to financial risk control by providing an intelligent and efficient credit card fraud detection system that effectively handles complex transaction networks and imbalanced data, thereby improving the reliability of fraud detection systems.

Technical Contribution

The introduction of heterogeneous graph attention mechanism and time decay strategy significantly improves the performance of credit card fraud detection, ensuring high generalization ability and interpretability in practical applications.

Novelty

This work stands out by focusing on heterogeneous graph modeling for fraud detection tasks, effectively leveraging the structural information in transaction networks and addressing data imbalance issues through SMOTE and cost-sensitive learning techniques.

Limitations

- The temporal decay strategy does not fully capture long-term dependencies in transaction sequences.

- The model's performance may not generalize well to evolving fraud patterns that adapt to changes in security policies.

Future Work

- Investigate the integration of Transformer or LSTM architectures to enhance temporal modeling and improve the model's generalization over time.

- Explore the use of multi-modal data, such as user behavior logs, geographic location information, email address attributes, and device fingerprints, to further enhance fraud detection accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCaT-GNN: Enhancing Credit Card Fraud Detection via Causal Temporal Graph Neural Networks

Xinke Jiang, Hao Wu, Yifan Duan et al.

detectGNN: Harnessing Graph Neural Networks for Enhanced Fraud Detection in Credit Card Transactions

Naresh Kshetri, Irin Sultana, Syed Mustavi Maheen et al.

Semi-supervised Credit Card Fraud Detection via Attribute-Driven Graph Representation

Ling Chen, Yefeng Zheng, Yi Ouyang et al.

Effective High-order Graph Representation Learning for Credit Card Fraud Detection

Dawei Cheng, Yao Zou

No citations found for this paper.

Comments (0)