Summary

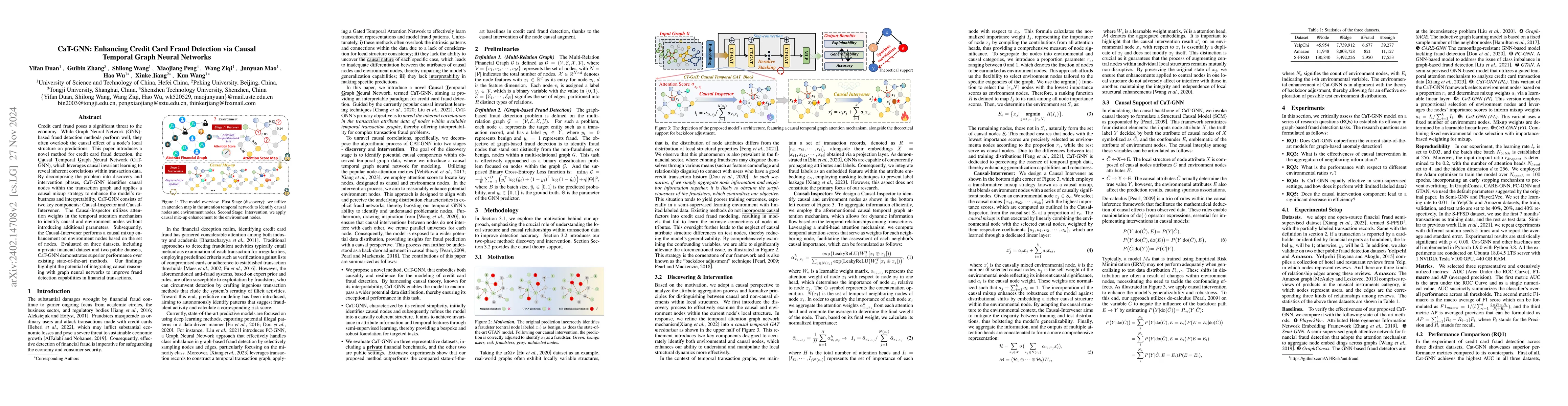

Credit card fraud poses a significant threat to the economy. While Graph Neural Network (GNN)-based fraud detection methods perform well, they often overlook the causal effect of a node's local structure on predictions. This paper introduces a novel method for credit card fraud detection, the \textbf{\underline{Ca}}usal \textbf{\underline{T}}emporal \textbf{\underline{G}}raph \textbf{\underline{N}}eural \textbf{N}etwork (CaT-GNN), which leverages causal invariant learning to reveal inherent correlations within transaction data. By decomposing the problem into discovery and intervention phases, CaT-GNN identifies causal nodes within the transaction graph and applies a causal mixup strategy to enhance the model's robustness and interpretability. CaT-GNN consists of two key components: Causal-Inspector and Causal-Intervener. The Causal-Inspector utilizes attention weights in the temporal attention mechanism to identify causal and environment nodes without introducing additional parameters. Subsequently, the Causal-Intervener performs a causal mixup enhancement on environment nodes based on the set of nodes. Evaluated on three datasets, including a private financial dataset and two public datasets, CaT-GNN demonstrates superior performance over existing state-of-the-art methods. Our findings highlight the potential of integrating causal reasoning with graph neural networks to improve fraud detection capabilities in financial transactions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDetecting Credit Card Fraud via Heterogeneous Graph Neural Networks with Graph Attention

Jie Liu, Yixian Wang, Xinyu Du et al.

Enhancing Credit Card Fraud Detection A Neural Network and SMOTE Integrated Approach

Ye Zhang, Yulu Gong, Mengran Zhu et al.

detectGNN: Harnessing Graph Neural Networks for Enhanced Fraud Detection in Credit Card Transactions

Naresh Kshetri, Irin Sultana, Syed Mustavi Maheen et al.

Semi-supervised Credit Card Fraud Detection via Attribute-Driven Graph Representation

Ling Chen, Yefeng Zheng, Yi Ouyang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)