Authors

Summary

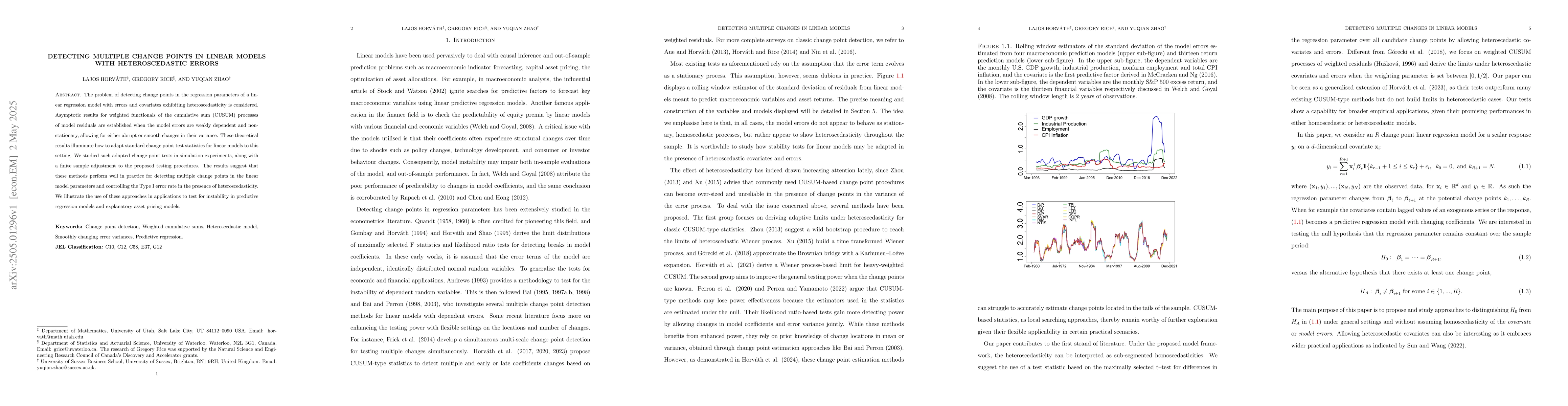

The problem of detecting change points in the regression parameters of a linear regression model with errors and covariates exhibiting heteroscedasticity is considered. Asymptotic results for weighted functionals of the cumulative sum (CUSUM) processes of model residuals are established when the model errors are weakly dependent and non-stationary, allowing for either abrupt or smooth changes in their variance. These theoretical results illuminate how to adapt standard change point test statistics for linear models to this setting. We studied such adapted change-point tests in simulation experiments, along with a finite sample adjustment to the proposed testing procedures. The results suggest that these methods perform well in practice for detecting multiple change points in the linear model parameters and controlling the Type I error rate in the presence of heteroscedasticity. We illustrate the use of these approaches in applications to test for instability in predictive regression models and explanatory asset pricing models.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs asymptotic results for weighted functionals of cumulative sum (CUSUM) processes of model residuals, adapting standard change point test statistics for linear models with heteroscedastic errors under weakly dependent and non-stationary error processes.

Key Results

- Theoretical results for asymptotic behavior of CUSUM processes are established for model errors with abrupt or smooth changes in variance.

- Simulation experiments demonstrate the effectiveness of adapted testing procedures in detecting multiple change points and controlling Type I error rate.

- The methods are illustrated through applications in predictive regression models and asset pricing models.

Significance

This work is significant as it provides a robust framework for detecting change points in linear models with heteroscedastic errors, which is crucial in various fields such as econometrics, finance, and signal processing.

Technical Contribution

The paper presents novel theoretical results on the asymptotic properties of CUSUM-based tests for change points in linear regression models with heteroscedastic, weakly dependent, and non-stationary errors.

Novelty

This research extends existing change point detection methods by adapting them to handle heteroscedasticity, providing a practical solution for a common issue in real-world data analysis.

Limitations

- The study assumes weakly dependent and non-stationary errors, which may not cover all real-world scenarios.

- The performance of the methods may vary with different types and degrees of heteroscedasticity not explicitly tested.

Future Work

- Further research could explore the application of these methods to non-linear models with heteroscedastic errors.

- Investigating the performance of these tests under more complex dependency structures of the errors.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Linear Errors-in-Variables Model with Unknown Heteroscedastic Measurement Errors

Linh H. Nghiem, Cornelis J. Potgieter

A novel framework for detecting multiple change points in functional data sequences

Xin Liu, Zhiqing Fang

No citations found for this paper.

Comments (0)