Summary

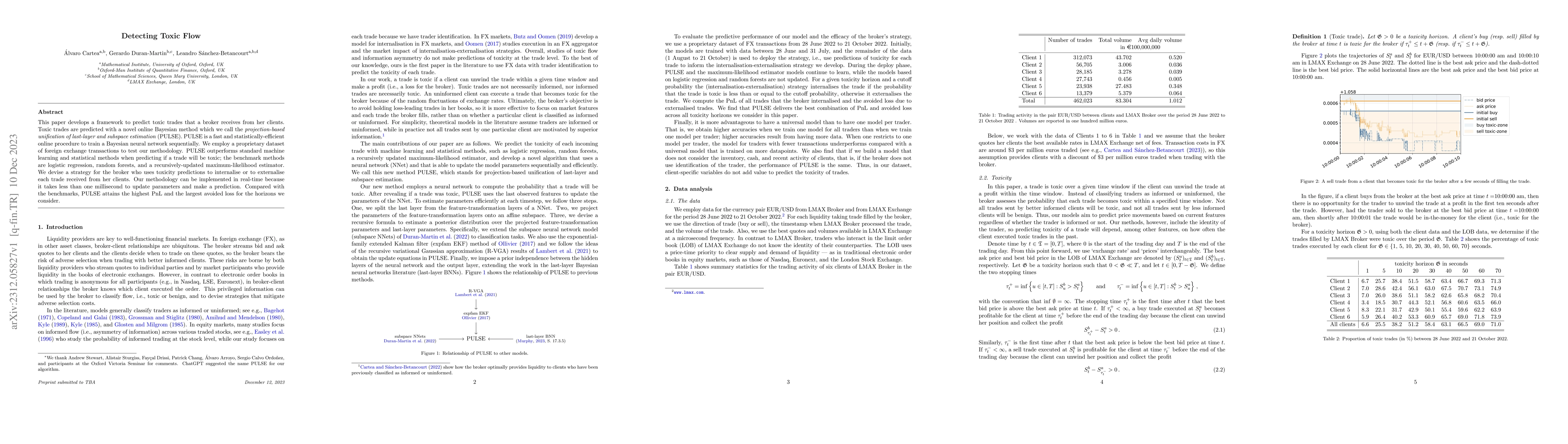

This paper develops a framework to predict toxic trades that a broker receives from her clients. Toxic trades are predicted with a novel online Bayesian method which we call the projection-based unification of last-layer and subspace estimation (PULSE). PULSE is a fast and statistically-efficient online procedure to train a Bayesian neural network sequentially. We employ a proprietary dataset of foreign exchange transactions to test our methodology. PULSE outperforms standard machine learning and statistical methods when predicting if a trade will be toxic; the benchmark methods are logistic regression, random forests, and a recursively-updated maximum-likelihood estimator. We devise a strategy for the broker who uses toxicity predictions to internalise or to externalise each trade received from her clients. Our methodology can be implemented in real-time because it takes less than one millisecond to update parameters and make a prediction. Compared with the benchmarks, PULSE attains the highest PnL and the largest avoided loss for the horizons we consider.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDetecting Unintended Social Bias in Toxic Language Datasets

Pushpak Bhattacharyya, Himanshu Gupta, Nihar Sahoo

Cross-Domain Toxic Spans Detection

Piek Vossen, Ilia Markov, Stefan F. Schouten et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)