Summary

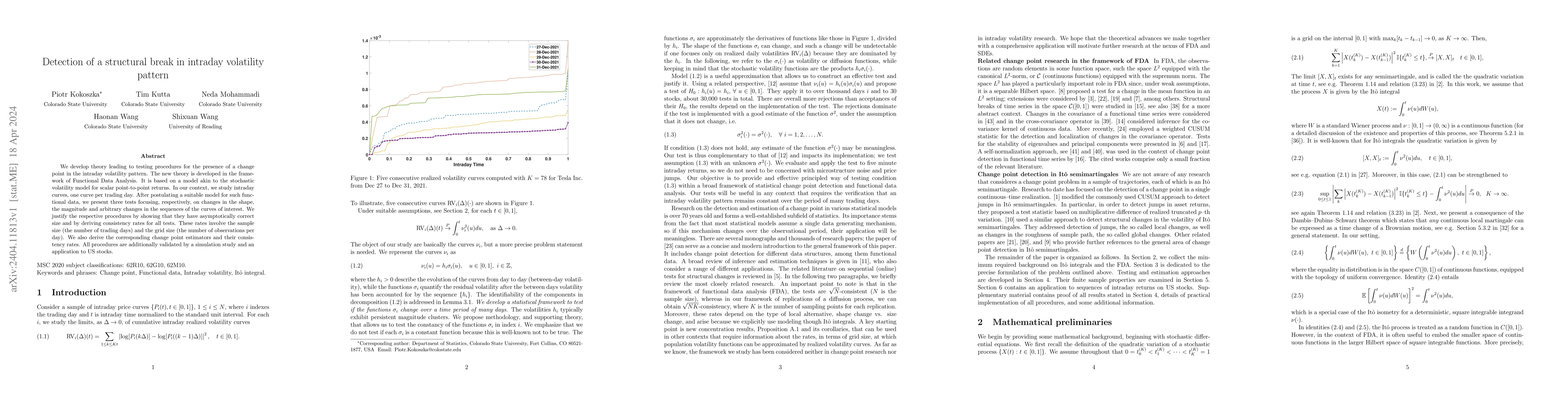

We develop theory leading to testing procedures for the presence of a change point in the intraday volatility pattern. The new theory is developed in the framework of Functional Data Analysis. It is based on a model akin to the stochastic volatility model for scalar point-to-point returns. In our context, we study intraday curves, one curve per trading day. After postulating a suitable model for such functional data, we present three tests focusing, respectively, on changes in the shape, the magnitude and arbitrary changes in the sequences of the curves of interest. We justify the respective procedures by showing that they have asymptotically correct size and by deriving consistency rates for all tests. These rates involve the sample size (the number of trading days) and the grid size (the number of observations per day). We also derive the corresponding change point estimators and their consistency rates. All procedures are additionally validated by a simulation study and an application to US stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMatrix-based Prediction Approach for Intraday Instantaneous Volatility Vector

Donggyu Kim, Sung Hoon Choi

Volatility forecasting with machine learning and intraday commonality

Chao Zhang, Mihai Cucuringu, Zhongmin Qian et al.

No citations found for this paper.

Comments (0)