Authors

Summary

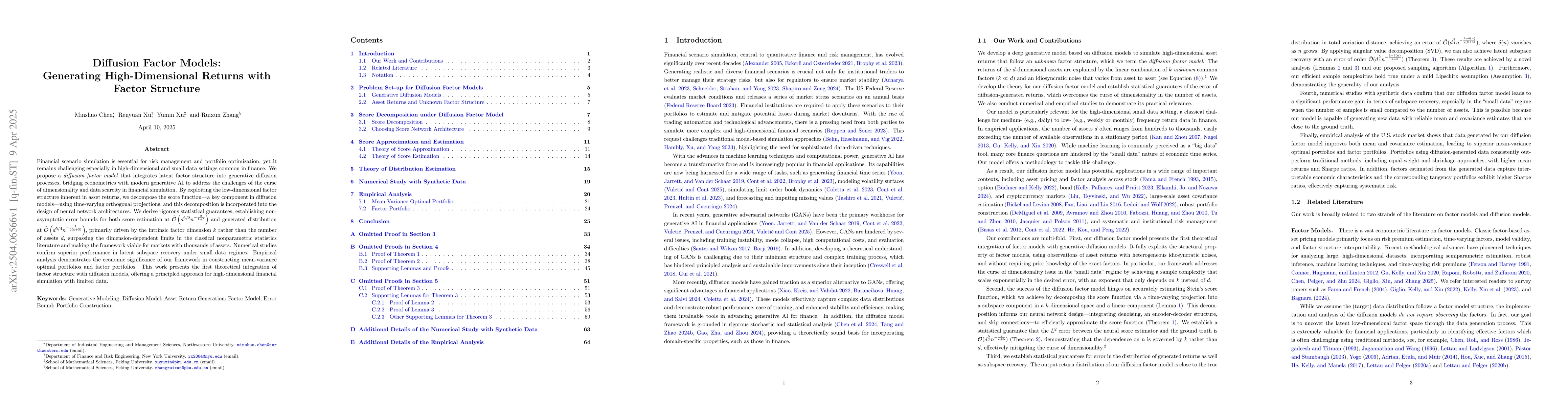

Financial scenario simulation is essential for risk management and portfolio optimization, yet it remains challenging especially in high-dimensional and small data settings common in finance. We propose a diffusion factor model that integrates latent factor structure into generative diffusion processes, bridging econometrics with modern generative AI to address the challenges of the curse of dimensionality and data scarcity in financial simulation. By exploiting the low-dimensional factor structure inherent in asset returns, we decompose the score function--a key component in diffusion models--using time-varying orthogonal projections, and this decomposition is incorporated into the design of neural network architectures. We derive rigorous statistical guarantees, establishing nonasymptotic error bounds for both score estimation at O(d^{5/2} n^{-2/(k+5)}) and generated distribution at O(d^{5/4} n^{-1/2(k+5)}), primarily driven by the intrinsic factor dimension k rather than the number of assets d, surpassing the dimension-dependent limits in the classical nonparametric statistics literature and making the framework viable for markets with thousands of assets. Numerical studies confirm superior performance in latent subspace recovery under small data regimes. Empirical analysis demonstrates the economic significance of our framework in constructing mean-variance optimal portfolios and factor portfolios. This work presents the first theoretical integration of factor structure with diffusion models, offering a principled approach for high-dimensional financial simulation with limited data.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper proposes a diffusion factor model integrating latent factor structure into generative diffusion processes, addressing challenges in high-dimensional and small data settings in finance.

Key Results

- The model provides nonasymptotic error bounds for score estimation at O(d^{5/2} n^{-2/(k+5)}) and distribution recovery at O(d^{5/4} n^{-1/2(k+5)}), primarily driven by the intrinsic factor dimension k rather than the number of assets d.

- Numerical studies confirm superior performance in latent subspace recovery under small data regimes.

- Empirical analysis demonstrates the economic significance of the framework in constructing mean-variance optimal portfolios and factor portfolios.

- Diffusion-generated factors exhibit notable correlations with traditional factors, capturing systematic risk effectively.

Significance

This research presents the first theoretical integration of factor structure with diffusion models, offering a principled approach for high-dimensional financial simulation with limited data, which is crucial for risk management and portfolio optimization.

Technical Contribution

The paper introduces a novel diffusion factor model that decomposes the score function using time-varying orthogonal projections, incorporating these into neural network architectures for efficient high-dimensional financial simulations.

Novelty

The work is novel in bridging econometrics with modern generative AI, providing statistical guarantees for diffusion models in high-dimensional settings, and demonstrating improved performance in portfolio construction tasks.

Limitations

- The paper does not discuss potential computational challenges associated with scaling the proposed method to very large datasets.

- Limitations in the generalizability of the model to diverse financial markets beyond those considered in the empirical analysis.

Future Work

- Exploration of scalability improvements for handling massive datasets common in real-world financial applications.

- Investigating the model's applicability across various financial markets and asset classes.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDynamic Matrix Factor Models for High Dimensional Time Series

Han Xiao, Yuefeng Han, Rong Chen et al.

No citations found for this paper.

Comments (0)