Authors

Summary

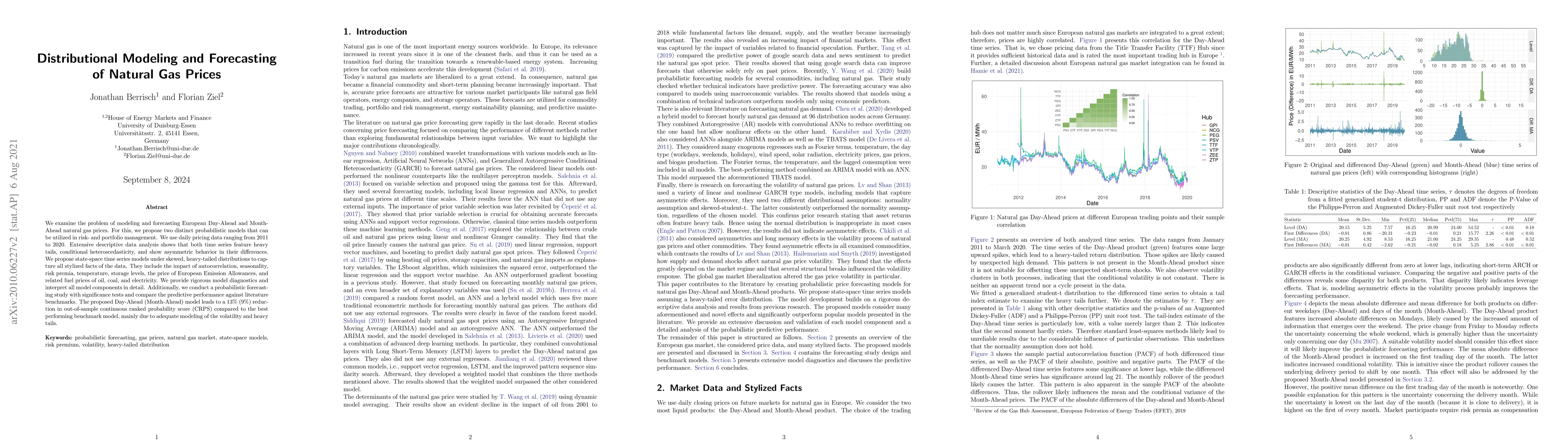

We examine the problem of modeling and forecasting European Day-Ahead and Month-Ahead natural gas prices. For this, we propose two distinct probabilistic models that can be utilized in risk- and portfolio management. We use daily pricing data ranging from 2011 to 2020. Extensive descriptive data analysis shows that both time series feature heavy tails, conditional heteroscedasticity, and show asymmetric behavior in their differences. We propose state-space time series models under skewed, heavy-tailed distributions to capture all stylized facts of the data. They include the impact of autocorrelation, seasonality, risk premia, temperature, storage levels, the price of European Emission Allowances, and related fuel prices of oil, coal, and electricity. We provide rigorous model diagnostics and interpret all model components in detail. Additionally, we conduct a probabilistic forecasting study with significance tests and compare the predictive performance against literature benchmarks. The proposed Day-Ahead (Month-Ahead) model leads to a 13% (9%) reduction in out-of-sample continuous ranked probability score (CRPS) compared to the best performing benchmark model, mainly due to adequate modeling of the volatility and heavy tails.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting Natural Gas Prices with Spatio-Temporal Copula-based Time Series Models

Sven Pappert, Antonia Arsova

Deep Distributional Time Series Models and the Probabilistic Forecasting of Intraday Electricity Prices

Michael Stanley Smith, David J. Nott, Nadja Klein

Distributional neural networks for electricity price forecasting

Florian Ziel, Rafał Weron, Grzegorz Marcjasz et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)