Authors

Summary

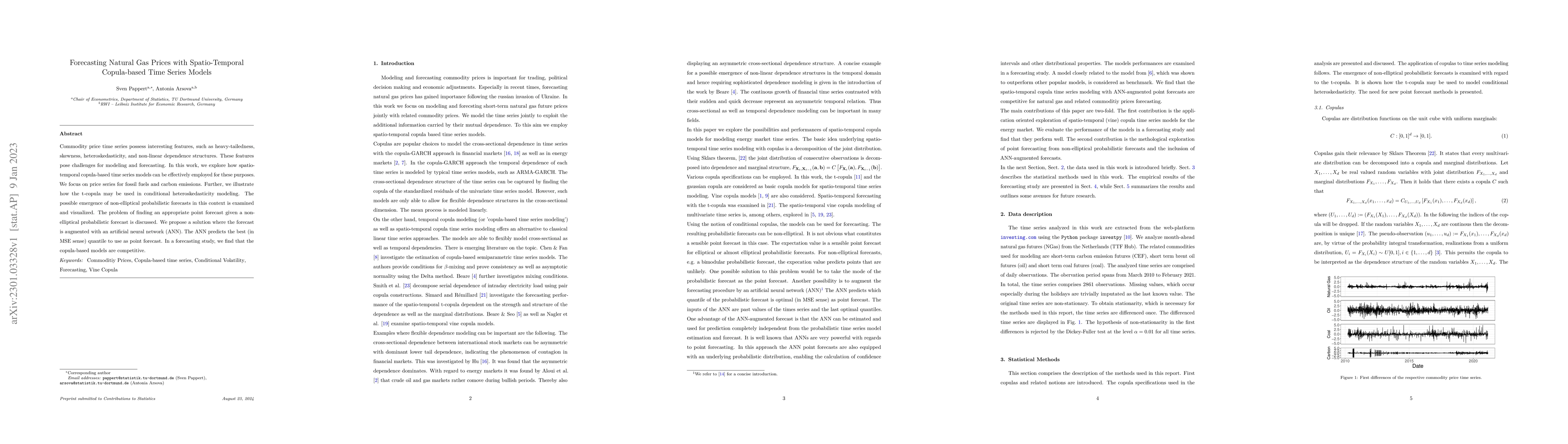

Commodity price time series possess interesting features, such as heavy-tailedness, skewness, heteroskedasticity, and non-linear dependence structures. These features pose challenges for modeling and forecasting. In this work, we explore how spatio-temporal copula-based time series models can be effectively employed for these purposes. We focus on price series for fossil fuels and carbon emissions. Further, we illustrate how the t-copula may be used in conditional heteroskedasticity modeling. The possible emergence of non-elliptical probabilistic forecasts in this context is examined and visualized. The problem of finding an appropriate point forecast given a non-elliptical probabilistic forecast is discussed. We propose a solution where the forecast is augmented with an artificial neural network (ANN). The ANN predicts the best (in MSE sense) quantile to use as point forecast. In a forecasting study, we find that the copula-based models are competitive.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Spatio-Temporal Aware Traffic Time Series Forecasting--Full Version

Shirui Pan, Chenjuan Guo, Bin Yang et al.

Distributional Modeling and Forecasting of Natural Gas Prices

Jonathan Berrisch, Florian Ziel

Deep Distributional Time Series Models and the Probabilistic Forecasting of Intraday Electricity Prices

Michael Stanley Smith, David J. Nott, Nadja Klein

Stecformer: Spatio-temporal Encoding Cascaded Transformer for Multivariate Long-term Time Series Forecasting

Yi Wei, Zheng Sun, Long Yu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)