Authors

Summary

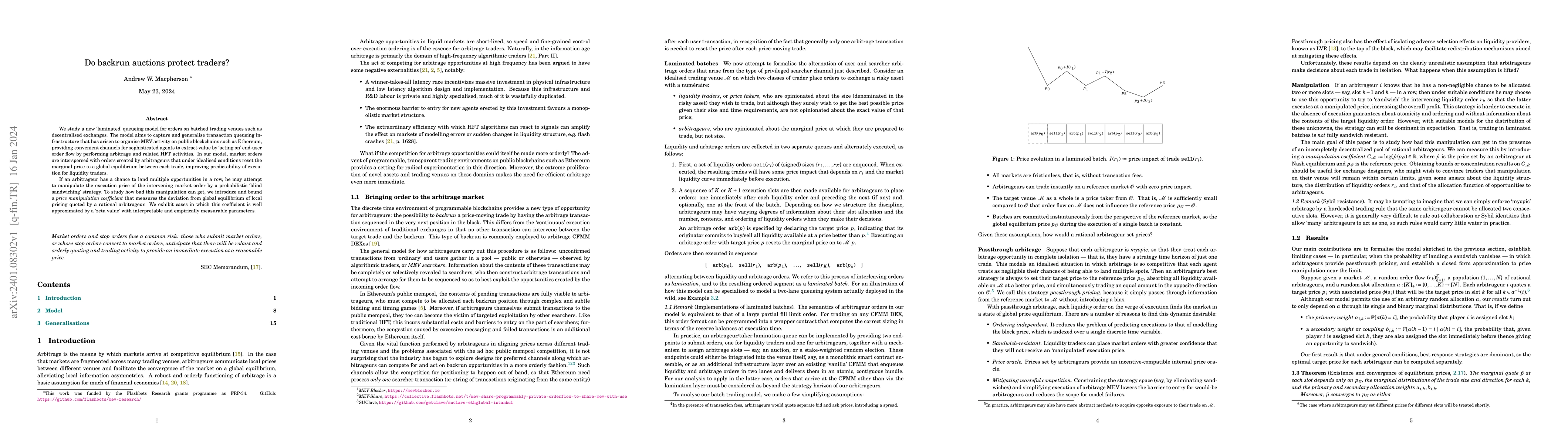

We study a new "laminated" queueing model for orders on batched trading venues such as decentralised exchanges. The model aims to capture and generalise transaction queueing infrastructure that has arisen to organise MEV activity on public blockchains such as Ethereum, providing convenient channels for sophisticated agents to extract value by acting on end-user order flow by performing arbitrage and related HFT activities. In our model, market orders are interspersed with orders created by arbitrageurs that under idealised conditions reset the marginal price to a global equilibrium between each trade, improving predictability of execution for liquidity traders. If an arbitrageur has a chance to land multiple opportunities in a row, he may attempt to manipulate the execution price of the intervening market order by a probabilistic blind sandwiching strategy. To study how bad this manipulation can get, we introduce and bound a price manipulation coefficient that measures the deviation from global equilibrium of local pricing quoted by a rational arbitrageur. We exhibit cases in which this coefficient is well approximated by a "zeta value' with interpretable and empirically measurable parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersHow Do Digital Advertising Auctions Impact Product Prices?

Dirk Bergemann, Nicholas Wu, Alessandro Bonatti

No citations found for this paper.

Comments (0)