Summary

Exchanges implement intentional trade delays to limit the harmful impact of low-latency trading. Do such "speed bumps" curb investment in fast trading technology? Data is scarce since trading technologies are proprietary. We build an experimental trading platform where participants face speed bumps and can invest in fast trading technology. We find that asymmetric speed bumps, on average, reduce investment in speed by only 20%. Increasing the magnitude of the speed bump by one standard deviation further reduces low-latency investment by 8.33%. Finally, introducing a symmetric speed bump leads to the same investment level as no speed bump at all.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

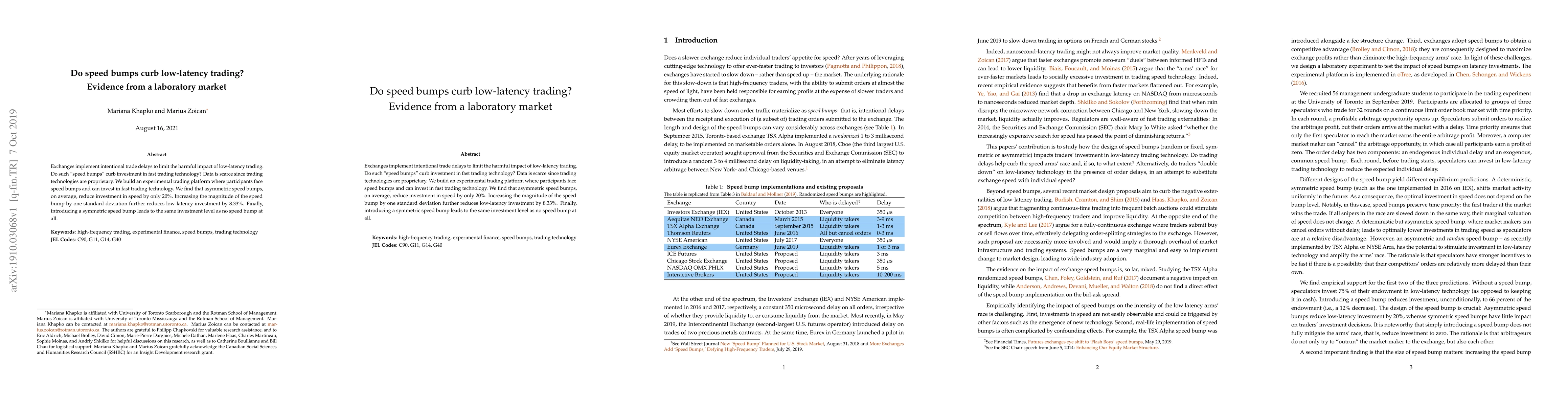

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersC++ Design Patterns for Low-latency Applications Including High-frequency Trading

Paul Bilokon, Burak Gunduz

| Title | Authors | Year | Actions |

|---|

Comments (0)