Summary

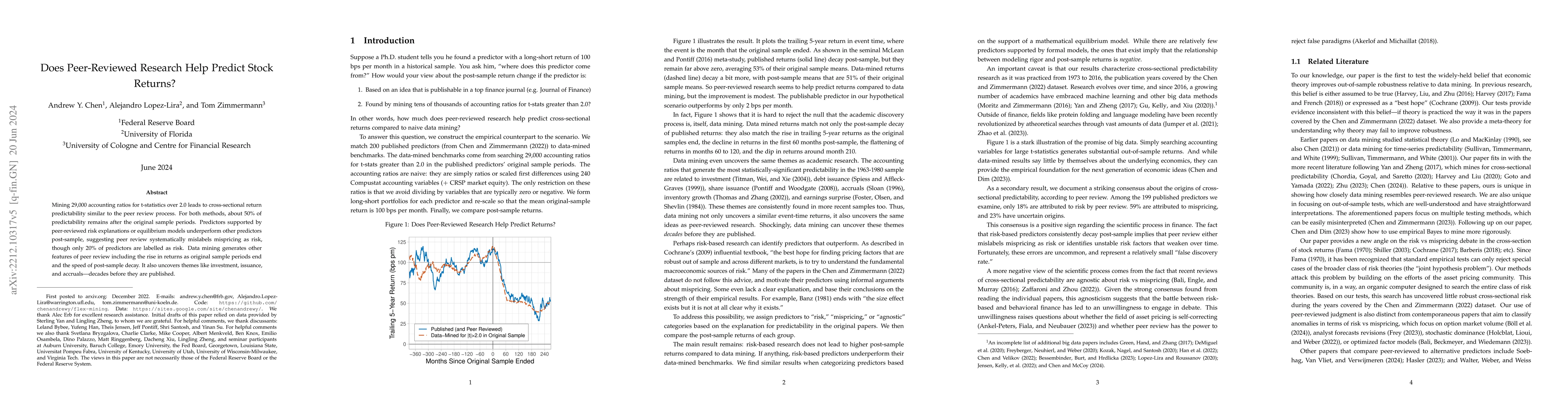

Mining 29,000 accounting ratios for t-statistics over 2.0 leads to cross-sectional return predictability similar to the peer review process. For both methods, about 50% of predictability remains after the original sample periods. Predictors supported by peer-reviewed risk explanations or equilibrium models underperform other predictors post-sample, suggesting peer review systematically mislabels mispricing as risk, though only 20% of predictors are labelled as risk. Data mining generates other features of peer review including the rise in returns as original sample periods end and the speed of post-sample decay. It also uncovers themes like investment, issuance, and accruals -- decades before they are published.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUsing blogs to make peer-reviewed research more accessible

Briley L. Lewis, Nicholas T. Young, Emily Kerr et al.

Liquidity Costs, Idiosyncratic Volatility and Expected Stock Returns

M. Reza Bradrania, Maurice Peat, Stephen Satchell

| Title | Authors | Year | Actions |

|---|

Comments (0)