Summary

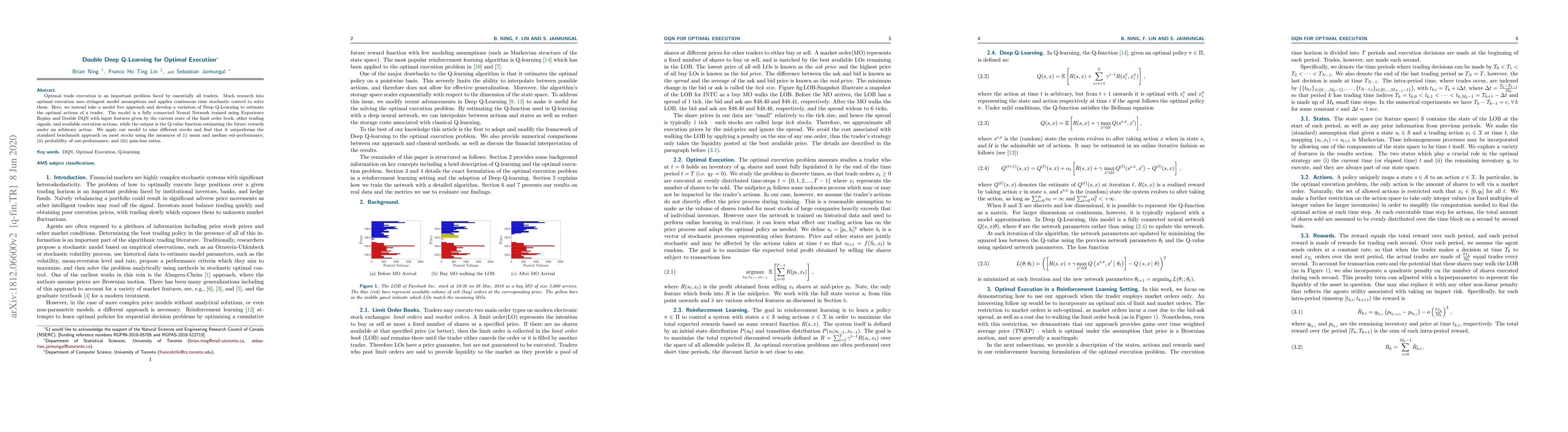

Optimal trade execution is an important problem faced by essentially all traders. Much research into optimal execution uses stringent model assumptions and applies continuous time stochastic control to solve them. Here, we instead take a model free approach and develop a variation of Deep Q-Learning to estimate the optimal actions of a trader. The model is a fully connected Neural Network trained using Experience Replay and Double DQN with input features given by the current state of the limit order book, other trading signals, and available execution actions, while the output is the Q-value function estimating the future rewards under an arbitrary action. We apply our model to nine different stocks and find that it outperforms the standard benchmark approach on most stocks using the measures of (i) mean and median out-performance, (ii) probability of out-performance, and (iii) gain-loss ratios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Online Optimal Execution Strategies

Mélodie Monod, Alessandro Micheli

Double Q-learning for Value-based Deep Reinforcement Learning, Revisited

Martha White, Marlos C. Machado, Prabhat Nagarajan

Asynchronous Deep Double Duelling Q-Learning for Trading-Signal Execution in Limit Order Book Markets

Stefan Zohren, Jan-Peter Calliess, Peer Nagy

| Title | Authors | Year | Actions |

|---|

Comments (0)