Authors

Summary

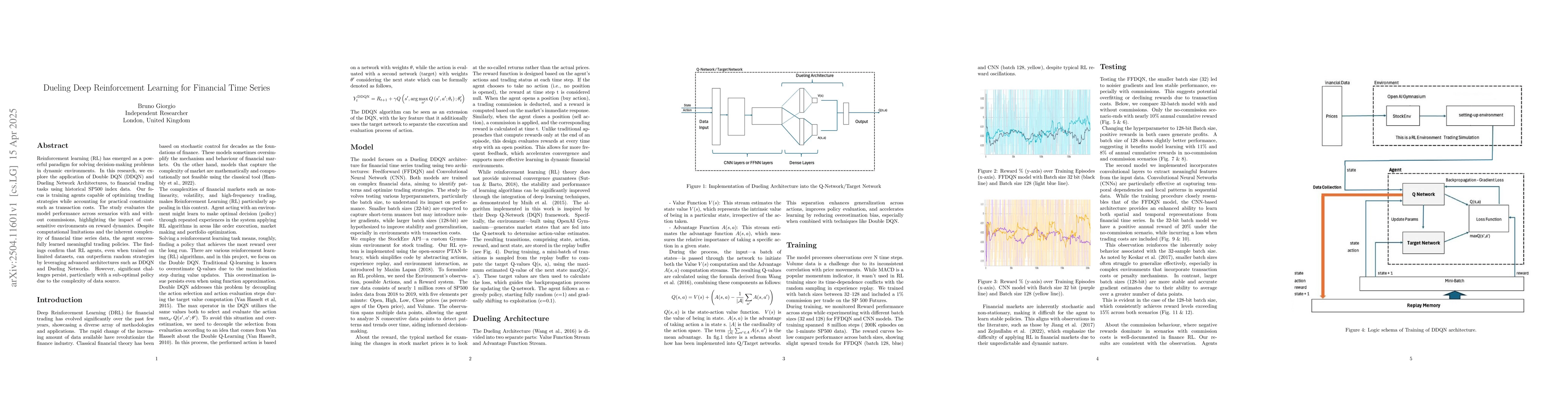

Reinforcement learning (RL) has emerged as a powerful paradigm for solving decision-making problems in dynamic environments. In this research, we explore the application of Double DQN (DDQN) and Dueling Network Architectures, to financial trading tasks using historical SP500 index data. Our focus is training agents capable of optimizing trading strategies while accounting for practical constraints such as transaction costs. The study evaluates the model performance across scenarios with and without commissions, highlighting the impact of cost-sensitive environments on reward dynamics. Despite computational limitations and the inherent complexity of financial time series data, the agent successfully learned meaningful trading policies. The findings confirm that RL agents, even when trained on limited datasets, can outperform random strategies by leveraging advanced architectures such as DDQN and Dueling Networks. However, significant challenges persist, particularly with a sub-optimal policy due to the complexity of data source.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research applies Double Deep Q-Network (DDQN) and Dueling Network Architectures to financial trading tasks using historical S&P500 index data, training agents to optimize trading strategies while considering practical constraints like transaction costs.

Key Results

- Reinforcement Learning (RL) agents, even when trained on limited datasets, can outperform random strategies by leveraging advanced architectures such as DDQN and Dueling Networks.

- Larger batch sizes (128) show better performance and more stable learning, especially in the presence of transaction costs, compared to smaller batch sizes (32).

- The Dueling DDQN architecture demonstrates promising results in financial trading, achieving positive returns, especially in no-commission settings, and adapting well to transaction costs with larger batch sizes.

Significance

This research is important as it explores the application of RL in financial trading, which is inherently complex and non-stationary, and aims to develop trading agents capable of optimizing strategies under practical constraints.

Technical Contribution

The paper introduces the implementation of Dueling DQN architecture into Q-Networks, enhancing generalization across actions, improving policy evaluation, and accelerating learning by reducing overestimation bias.

Novelty

This work differentiates itself by applying advanced RL techniques, specifically DDQN and Dueling Networks, to financial time series data, evaluating their performance under cost-sensitive environments, and highlighting the impact of batch size on learning stability.

Limitations

- The study acknowledges the inherent complexity of financial time series data and computational limitations.

- A sub-optimal policy was observed due to the complexity of data sources.

Future Work

- Investigate the use of regularization techniques to mitigate overfitting and excessive trading during exploration phases.

- Explore the application of these methods on larger and more extensive datasets for enhanced generalization.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData Scaling Effect of Deep Learning in Financial Time Series Forecasting

Chen Liu, Chao Wang, Richard Gerlach et al.

No citations found for this paper.

Comments (0)