Summary

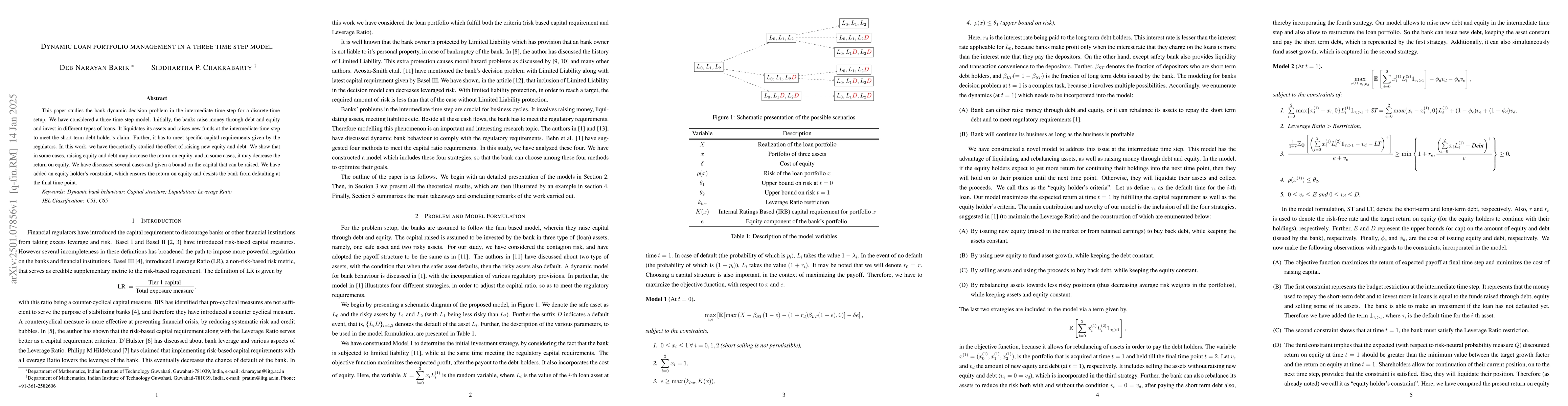

This paper studies the bank dynamic decision problem in the intermediate time step for a discrete-time setup. We have considered a three-time-step model. Initially, the banks raise money through debt and equity and invest in different types of loans. It liquidates its assets and raises new funds at the intermediate-time step to meet the short-term debt holders claim. Further, it has to meet specific capital requirements given by the regulators. In this work, we have theoretically studied the effect of raising new equity and debt. We show that in some cases, raising equity and debt may increase the return on equity, and in some cases, it may decrease the return on equity. We have discussed several cases and given a bound on the capital that can be raised. We have added an equity holders constraint, which ensures the return on equity and desists the bank from defaulting at the final time point.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersLoan portfolio management and Liquidity Risk: The impact of limited liability and haircut

Siddhartha P. Chakrabarty, Deb Narayan Barik

Does limited liability reduce leveraged risk?: The case of loan portfolio management

Siddhartha P. Chakrabarty, Deb Narayan Barik

Minimizing the Value-at-Risk of Loan Portfolio via Deep Neural Networks

Ye Du, Albert Di Wang

No citations found for this paper.

Comments (0)