Authors

Summary

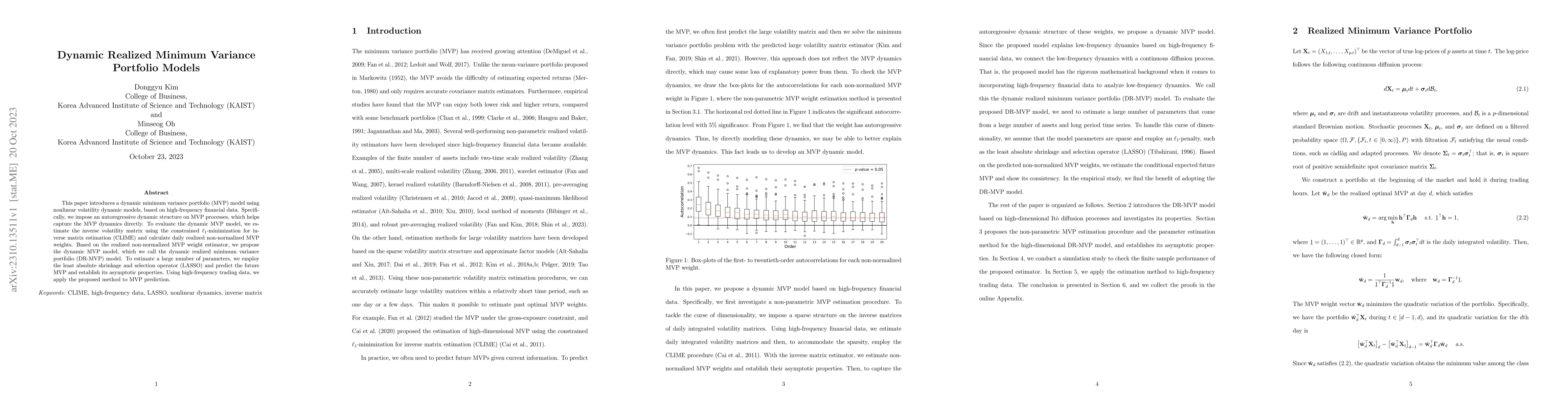

This paper introduces a dynamic minimum variance portfolio (MVP) model using nonlinear volatility dynamic models, based on high-frequency financial data. Specifically, we impose an autoregressive dynamic structure on MVP processes, which helps capture the MVP dynamics directly. To evaluate the dynamic MVP model, we estimate the inverse volatility matrix using the constrained $\ell_1$-minimization for inverse matrix estimation (CLIME) and calculate daily realized non-normalized MVP weights. Based on the realized non-normalized MVP weight estimator, we propose the dynamic MVP model, which we call the dynamic realized minimum variance portfolio (DR-MVP) model. To estimate a large number of parameters, we employ the least absolute shrinkage and selection operator (LASSO) and predict the future MVP and establish its asymptotic properties. Using high-frequency trading data, we apply the proposed method to MVP prediction.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper introduces a dynamic minimum variance portfolio (MVP) model using nonlinear volatility dynamic models, based on high-frequency financial data. It employs an autoregressive dynamic structure on MVP processes and uses CLIME and LASSO for estimation, ensuring asymptotic properties.

Key Results

- Proposed the dynamic realized minimum variance portfolio (DR-MVP) model.

- Established the asymptotic properties of the DR-MVP model.

- Demonstrated that the DR-MVP model outperforms other benchmarks in predicting MVP weights.

- Showed that sufficient high-frequency observations are needed to utilize the estimated MVP as input for DR-MVP models.

- Found that mean prediction errors for conditional non-normalized and normalized MVPs decrease with more high- or low-frequency observations.

Significance

This research is significant as it provides a novel approach to modeling dynamic MVPs using high-frequency data, which can improve portfolio optimization strategies in finance.

Technical Contribution

The paper presents a dynamic MVP model that incorporates high-frequency data and nonlinear volatility dynamics, providing a robust framework for MVP estimation.

Novelty

The proposed DR-MVP model stands out by directly capturing MVP dynamics and using an autoregressive structure, which is a novel approach in the context of high-frequency financial data analysis.

Limitations

- The model's performance may be sensitive to the choice of tuning parameters in LASSO and CLIME estimation.

- The empirical study is based on a specific dataset, and results may not generalize to all market conditions.

Future Work

- Investigate the performance of the DR-MVP model under different market regimes.

- Explore the application of the DR-MVP model to other asset classes and markets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Shrinkage Estimation of the High-Dimensional Minimum-Variance Portfolio

Taras Bodnar, Nestor Parolya, Erik Thorsen

Advancing Portfolio Optimization: Adaptive Minimum-Variance Portfolios and Minimum Risk Rate Frameworks

Svetlozar T. Rachev, Frank J. Fabozzi, Abootaleb Shirvani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)