Authors

Summary

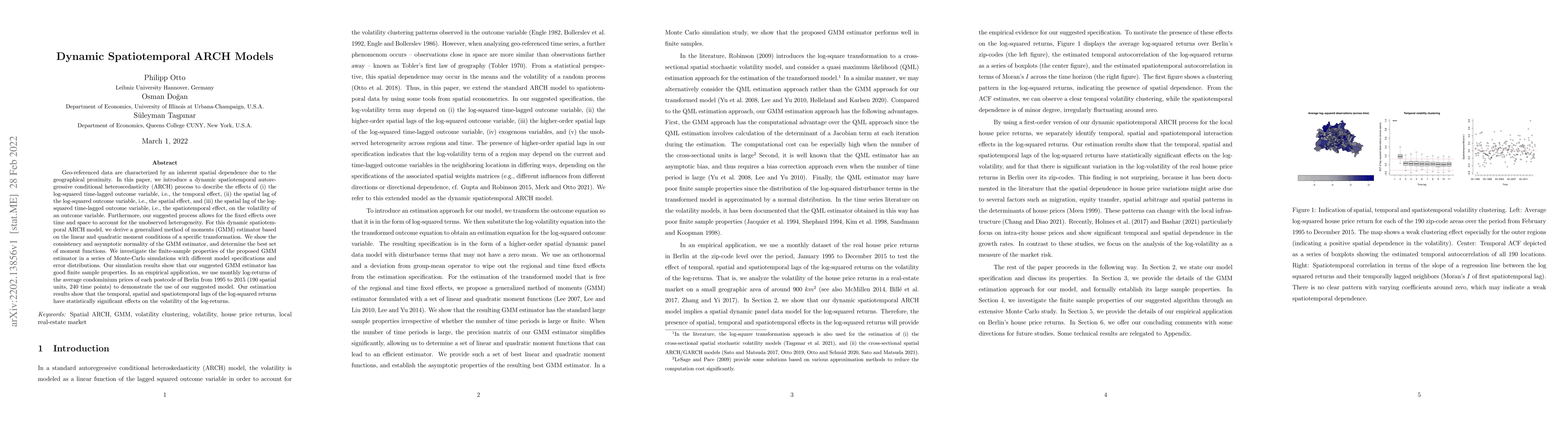

Geo-referenced data are characterized by an inherent spatial dependence due to the geographical proximity. In this paper, we introduce a dynamic spatiotemporal autoregressive conditional heteroscedasticity (ARCH) process to describe the effects of (i) the log-squared time-lagged outcome variable, i.e., the temporal effect, (ii) the spatial lag of the log-squared outcome variable, i.e., the spatial effect, and (iii) the spatial lag of the log-squared time-lagged outcome variable, i.e., the spatiotemporal effect, on the volatility of an outcome variable. Furthermore, our suggested process allows for the fixed effects over time and space to account for the unobserved heterogeneity. For this dynamic spatiotemporal ARCH model, we derive a generalized method of moments (GMM) estimator based on the linear and quadratic moment conditions of a specific transformation. We show the consistency and asymptotic normality of the GMM estimator, and determine the best set of moment functions. We investigate the finite-sample properties of the proposed GMM estimator in a series of Monte-Carlo simulations with different model specifications and error distributions. Our simulation results show that our suggested GMM estimator has good finite sample properties. In an empirical application, we use monthly log-returns of the average condominium prices of each postcode of Berlin from 1995 to 2015 (190 spatial units, 240 time points) to demonstrate the use of our suggested model. Our estimation results show that the temporal, spatial and spatiotemporal lags of the log-squared returns have statistically significant effects on the volatility of the log-returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Spatiotemporal ARCH Models: Small and Large Sample Results

Philipp Otto, Osman Doğan, Süleyman Taşpınar

Generalized Spatial and Spatiotemporal ARCH Models

Wolfgang Schmid, Philipp Otto

A Dynamic Spatiotemporal and Network ARCH Model with Common Factors

Philipp Otto, Osman Doğan, Süleyman Taşpınar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)