Authors

Summary

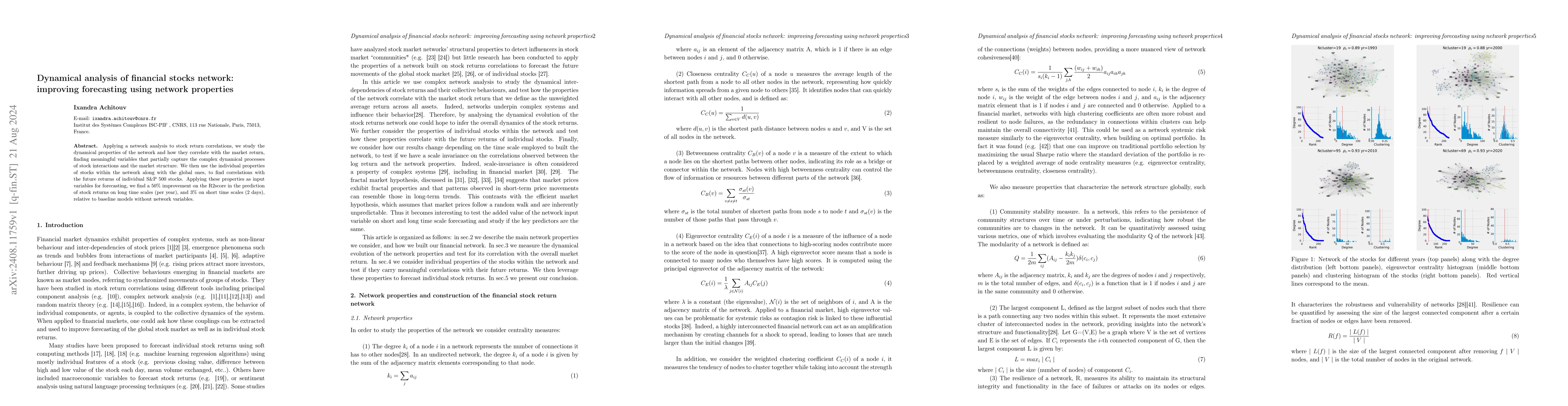

Applying a network analysis to stock return correlations, we study the dynamical properties of the network and how they correlate with the market return, finding meaningful variables that partially capture the complex dynamical processes of stock interactions and the market structure. We then use the individual properties of stocks within the network along with the global ones, to find correlations with the future returns of individual S&P 500 stocks. Applying these properties as input variables for forecasting, we find a 50% improvement on the R2score in the prediction of stock returns on long time scales (per year), and 3% on short time scales (2 days), relative to baseline models without network variables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)