Summary

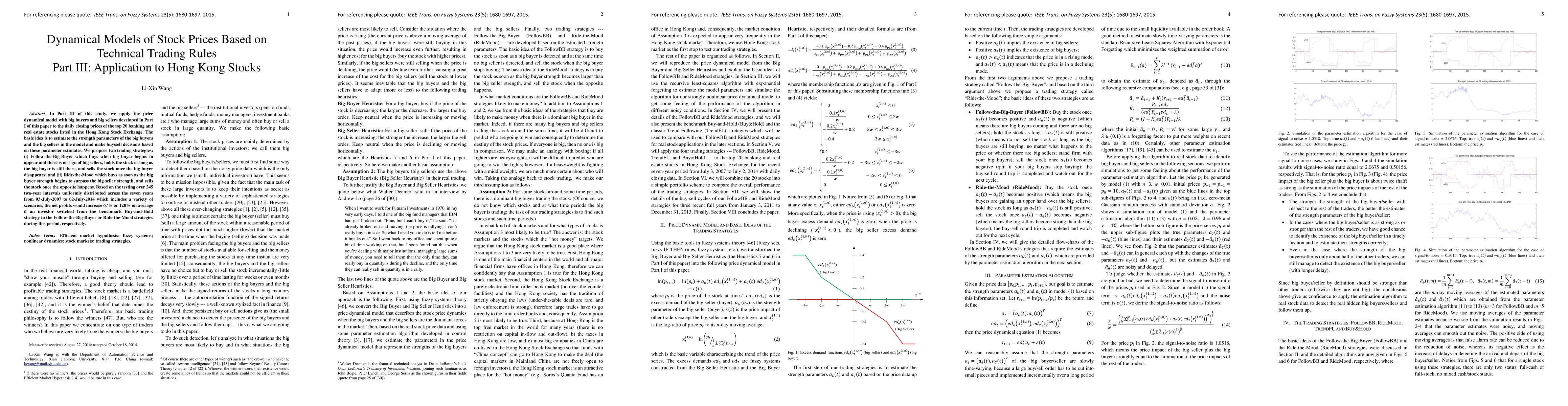

In Part III of this study, we apply the price dynamical model with big buyers and big sellers developed in Part I of this paper to the daily closing prices of the top 20 banking and real estate stocks listed in the Hong Kong Stock Exchange. The basic idea is to estimate the strength parameters of the big buyers and the big sellers in the model and make buy/sell decisions based on these parameter estimates. We propose two trading strategies: (i) Follow-the-Big-Buyer which buys when big buyer begins to appear and there is no sign of big sellers, holds the stock as long as the big buyer is still there, and sells the stock once the big buyer disappears; and (ii) Ride-the-Mood which buys as soon as the big buyer strength begins to surpass the big seller strength, and sells the stock once the opposite happens. Based on the testing over 245 two-year intervals uniformly distributed across the seven years from 03-July-2007 to 02-July-2014 which includes a variety of scenarios, the net profits would increase 67% or 120% on average if an investor switched from the benchmark Buy-and-Hold strategy to the Follow-the-Big-Buyer or Ride-the-Mood strategies during this period, respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)