Summary

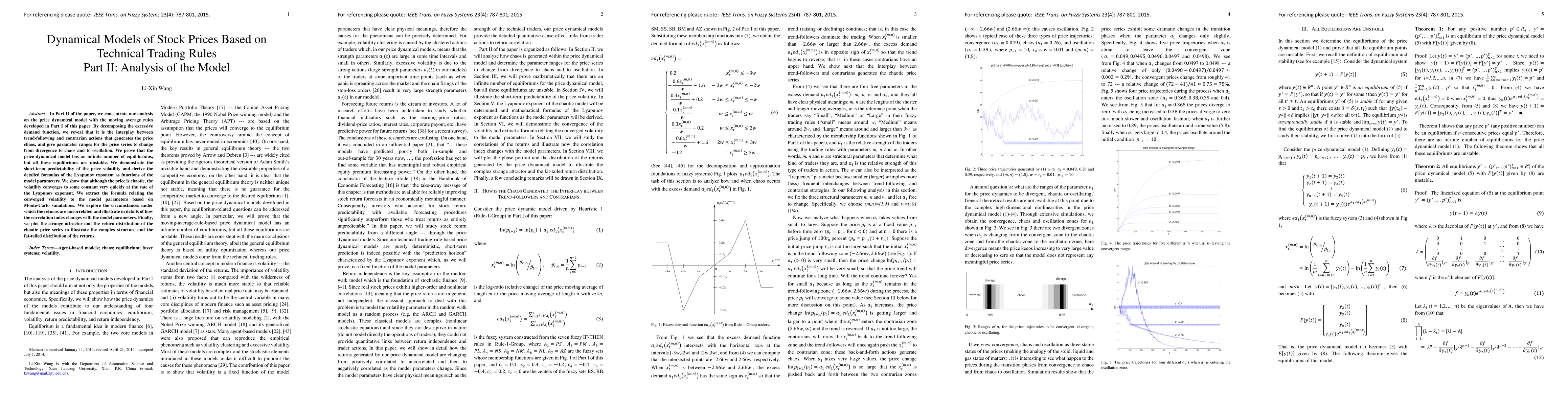

In Part II of this paper, we concentrate our analysis on the price dynamical model with the moving average rules developed in Part I of this paper. By decomposing the excessive demand function, we reveal that it is the interplay between trend-following and contrarian actions that generates the price chaos, and give parameter ranges for the price series to change from divergence to chaos and to oscillation. We prove that the price dynamical model has an infinite number of equilibrium points but all these equilibrium points are unstable. We demonstrate the short-term predictability of the return volatility and derive the detailed formula of the Lyapunov exponent as function of the model parameters. We show that although the price is chaotic, the volatility converges to some constant very quickly at the rate of the Lyapunov exponent. We extract the formula relating the converged volatility to the model parameters based on Monte-Carlo simulations. We explore the circumstances under which the returns show independency and illustrate in details how the independency index changes with the model parameters. Finally, we plot the strange attractor and return distribution of the chaotic price model to illustrate the complex structure and fat-tailed distribution of the returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)