Summary

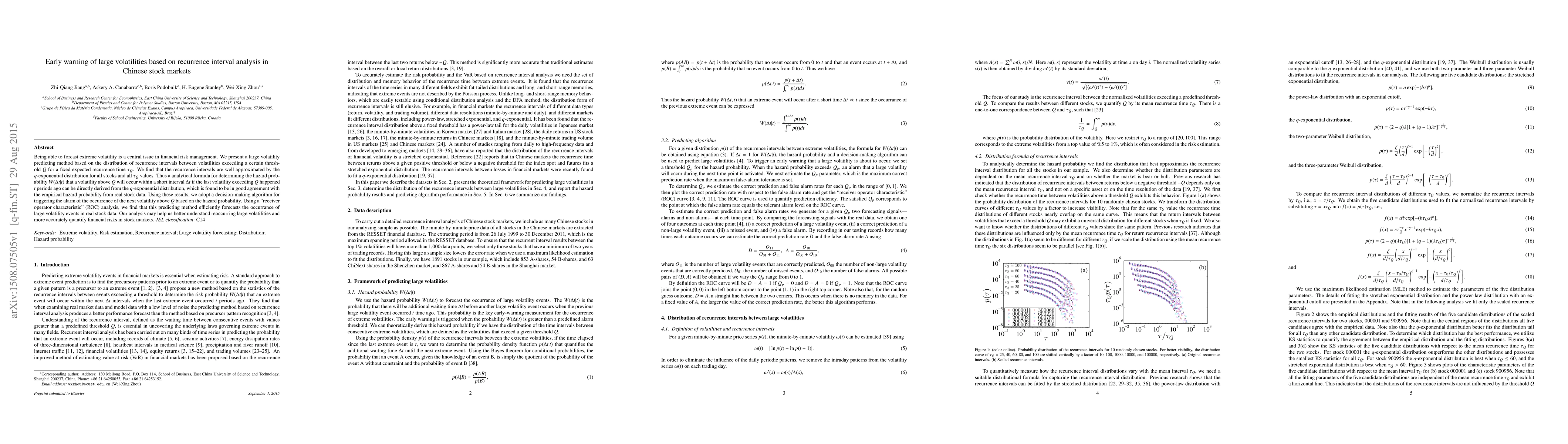

Being able to forcast extreme volatility is a central issue in financial risk management. We present a large volatility predicting method based on the distribution of recurrence intervals between volatilities exceeding a certain threshold $Q$ for a fixed expected recurrence time $\tau_Q$. We find that the recurrence intervals are well approximated by the $q$-exponential distribution for all stocks and all $\tau_Q$ values. Thus a analytical formula for determining the hazard probability $W(\Delta t |t)$ that a volatility above $Q$ will occur within a short interval $\Delta t$ if the last volatility exceeding $Q$ happened $t$ periods ago can be directly derived from the $q$-exponential distribution, which is found to be in good agreement with the empirical hazard probability from real stock data. Using these results, we adopt a decision-making algorithm for triggering the alarm of the occurrence of the next volatility above $Q$ based on the hazard probability. Using a "receiver operator characteristic" (ROC) analysis, we find that this predicting method efficiently forecasts the occurrance of large volatility events in real stock data. Our analysis may help us better understand reoccurring large volatilities and more accurately quantify financial risks in stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)