Summary

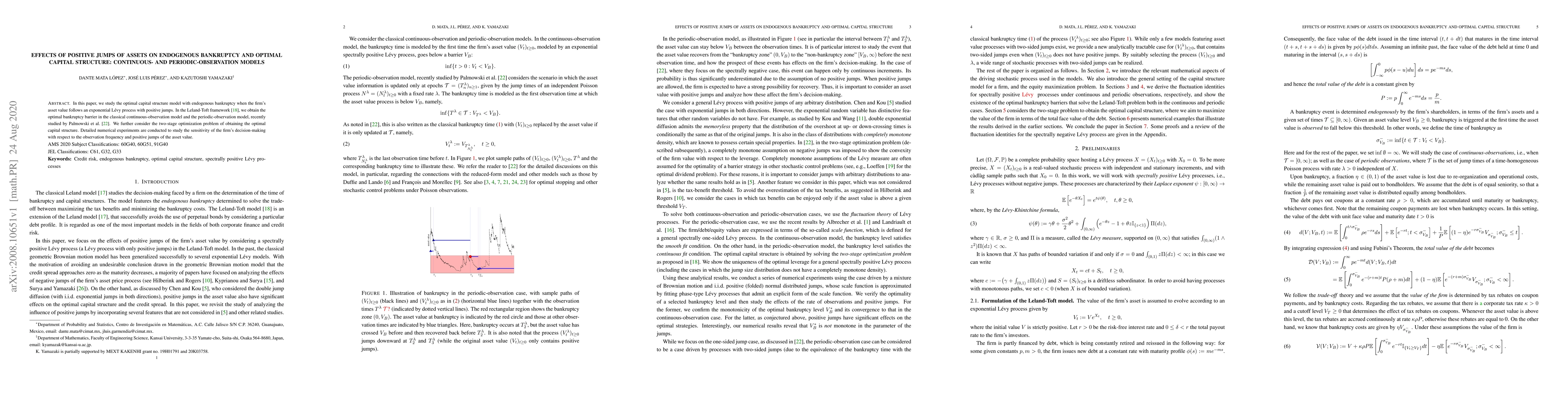

In this paper, we study the optimal capital structure model with endogenous bankruptcy when the firm's asset value follows an exponential L\'evy process with positive jumps. In the Leland-Toft framework \cite{LelandToft96}, we obtain the optimal bankruptcy barrier in the classical continuous-observation model and the periodic-observation model, recently studied by Palmowski et al.\ \cite{palmowski2019leland}. We further consider the two-stage optimization problem of obtaining the optimal capital structure. Detailed numerical experiments are conducted to study the sensitivity of the firm's decision-making with respect to the observation frequency and positive jumps of the asset value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)