Summary

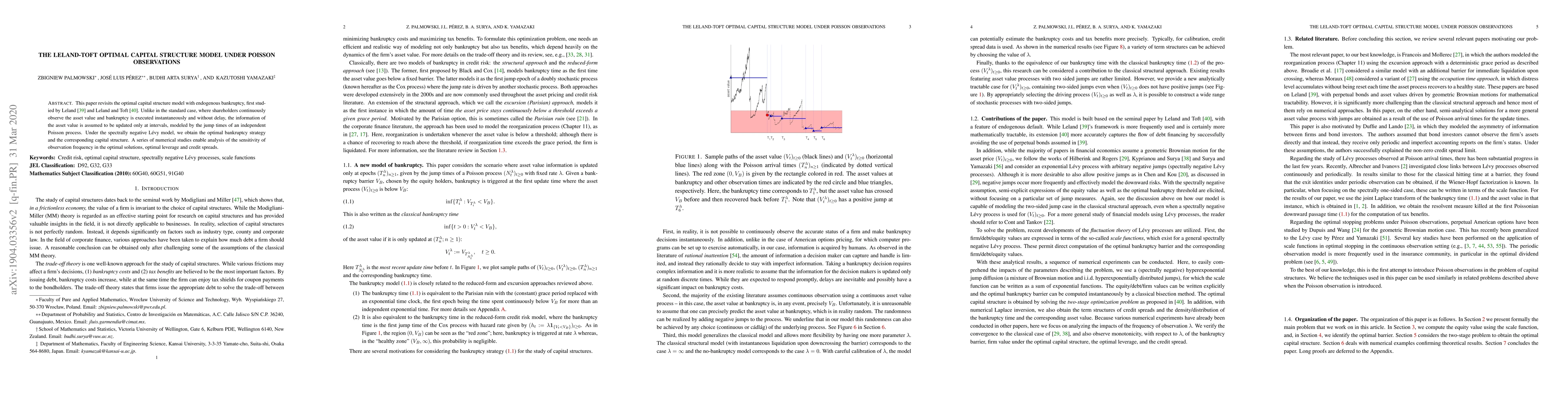

We revisit the optimal capital structure model with endogenous bankruptcy first studied by Leland \cite{Leland94} and Leland and Toft \cite{Leland96}. Differently from the standard case, where shareholders observe continuously the asset value and bankruptcy is executed instantaneously without delay, we assume that the information of the asset value is updated only at intervals, modeled by the jump times of an independent Poisson process. Under the spectrally negative L\'evy model, we obtain the optimal bankruptcy strategy and the corresponding capital structure. A series of numerical studies are given to analyze the sensitivity of observation frequency on the optimal solutions, the optimal leverage and the credit spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDe Finetti's Control Problem with Poisson Observations under Spectrally Positive Markov Additive Process

Lijun Bo, Wenyuan Wang, Kaixin Yan

| Title | Authors | Year | Actions |

|---|

Comments (0)