Summary

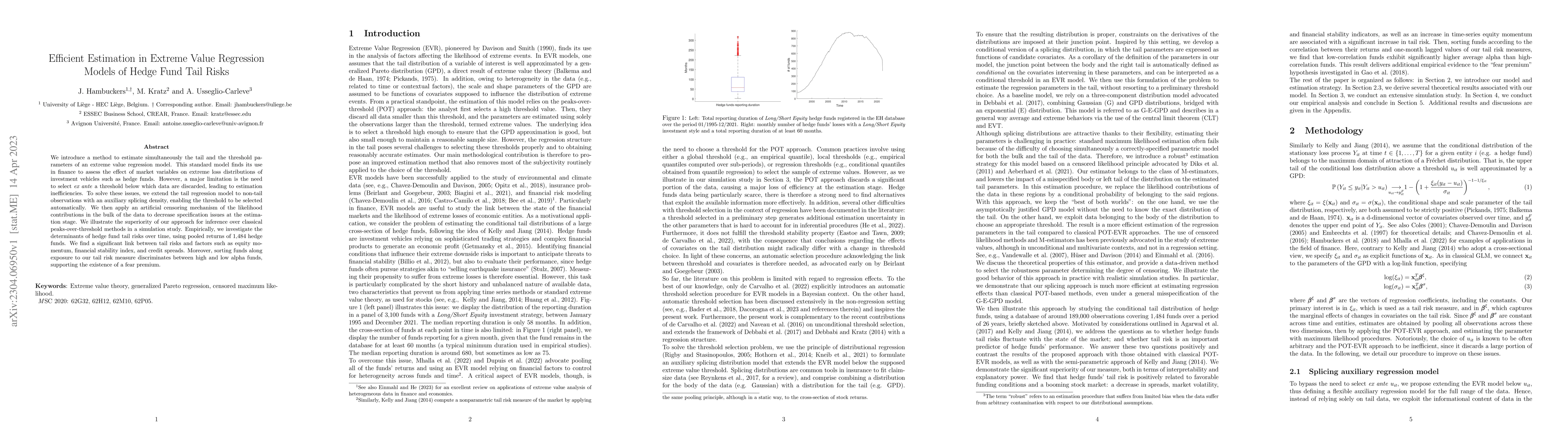

We introduce a method to estimate simultaneously the tail and the threshold parameters of an extreme value regression model. This standard model finds its use in finance to assess the effect of market variables on extreme loss distributions of investment vehicles such as hedge funds. However, a major limitation is the need to select ex ante a threshold below which data are discarded, leading to estimation inefficiencies. To solve these issues, we extend the tail regression model to non-tail observations with an auxiliary splicing density, enabling the threshold to be selected automatically. We then apply an artificial censoring mechanism of the likelihood contributions in the bulk of the data to decrease specification issues at the estimation stage. We illustrate the superiority of our approach for inference over classical peaks-over-threshold methods in a simulation study. Empirically, we investigate the determinants of hedge fund tail risks over time, using pooled returns of 1,484 hedge funds. We find a significant link between tail risks and factors such as equity momentum, financial stability index, and credit spreads. Moreover, sorting funds along exposure to our tail risk measure discriminates between high and low alpha funds, supporting the existence of a fear premium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-parametric cure models through extreme-value tail estimation

Martin Bladt, Ingrid Van Keilegom, Jan Beirlant

No citations found for this paper.

Comments (0)