Summary

This paper analyzes the benefits of sampling intraday returns in intrinsic time for the standard and pre-averaging realized variance (RV) estimators. We theoretically show in finite samples and asymptotically that the RV estimator is most efficient under the new concept of realized business time, which samples according to a combination of observed trades and estimated tick variance. Our asymptotic results carry over to the pre-averaging RV estimator under market microstructure noise. The analysis builds on the assumption that asset prices follow a diffusion that is time-changed with a jump process that separately models the transaction times. This provides a flexible model that separately captures the empirically varying trading intensity and tick variance processes, which are particularly relevant for disentangling the driving forces of the sampling schemes. Extensive simulations confirm our theoretical results and show that realized business time remains superior also under more general noise and process specifications. An application to stock data provides empirical evidence for the benefits of using realized business time sampling to construct more efficient RV estimators as well as for an improved forecasting performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

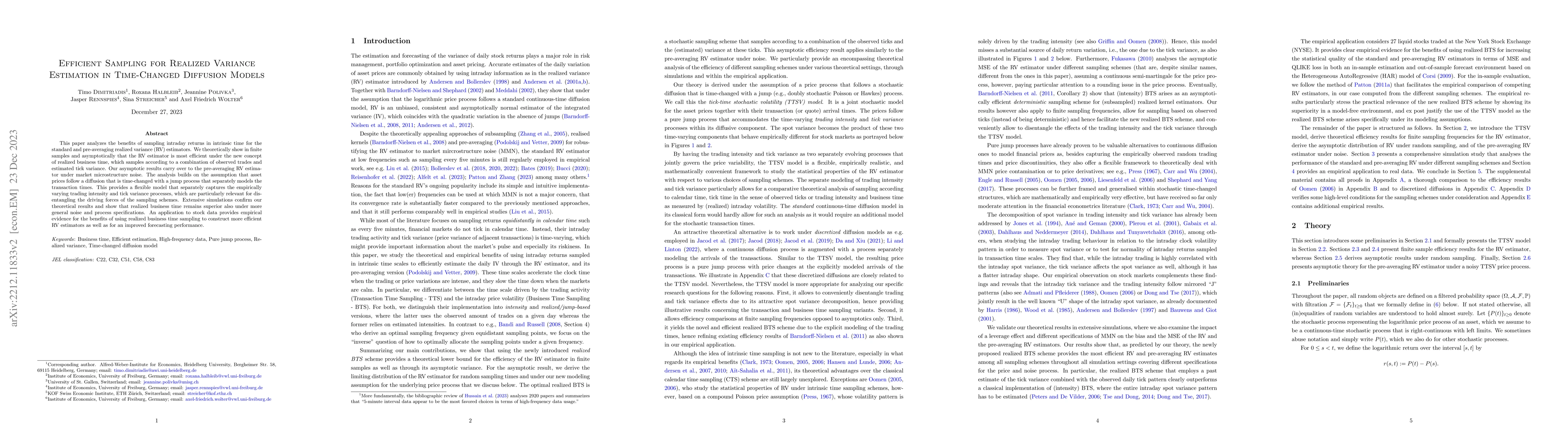

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient and Unbiased Sampling from Boltzmann Distributions via Variance-Tuned Diffusion Models

José Miguel Hernández-Lobato, Laurence I. Midgley, Fengzhe Zhang

No citations found for this paper.

Comments (0)