Summary

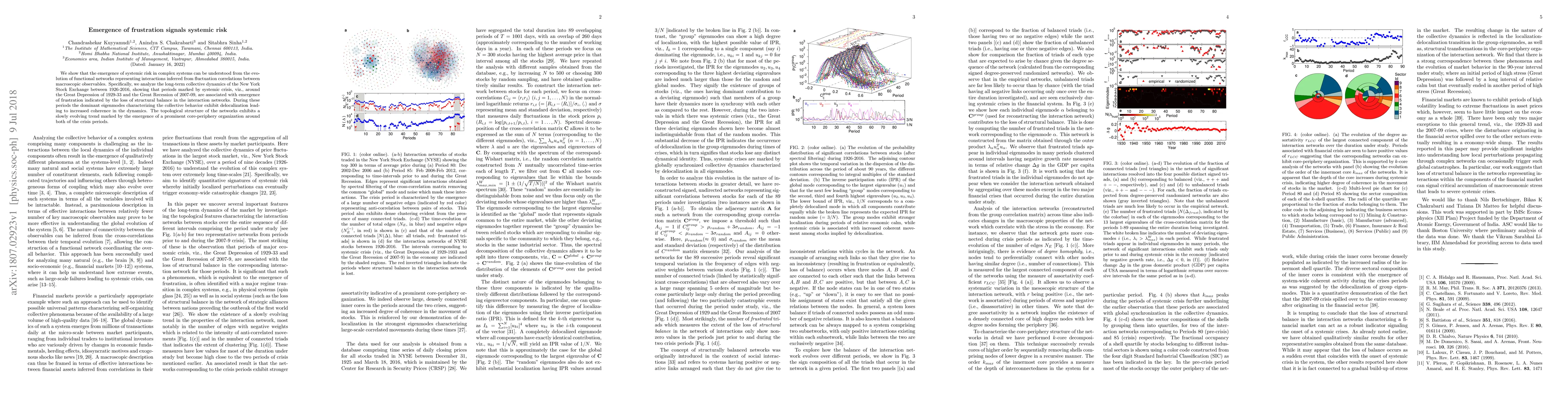

We show that the emergence of systemic risk in complex systems can be understood from the evolution of functional networks representing interactions inferred from fluctuation correlations between macroscopic observables. Specifically, we analyze the long-term collective dynamics of the New York Stock Exchange between 1926-2016, showing that periods marked by systemic crisis, viz., around the Great Depression of 1929-33 and the Great Recession of 2007-09, are associated with emergence of frustration indicated by the loss of structural balance in the interaction networks. During these periods the dominant eigenmodes characterizing the collective behavior exhibit delocalization leading to increased coherence in the dynamics. The topological structure of the networks exhibits a slowly evolving trend marked by the emergence of a prominent core-periphery organization around both of the crisis periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)