Summary

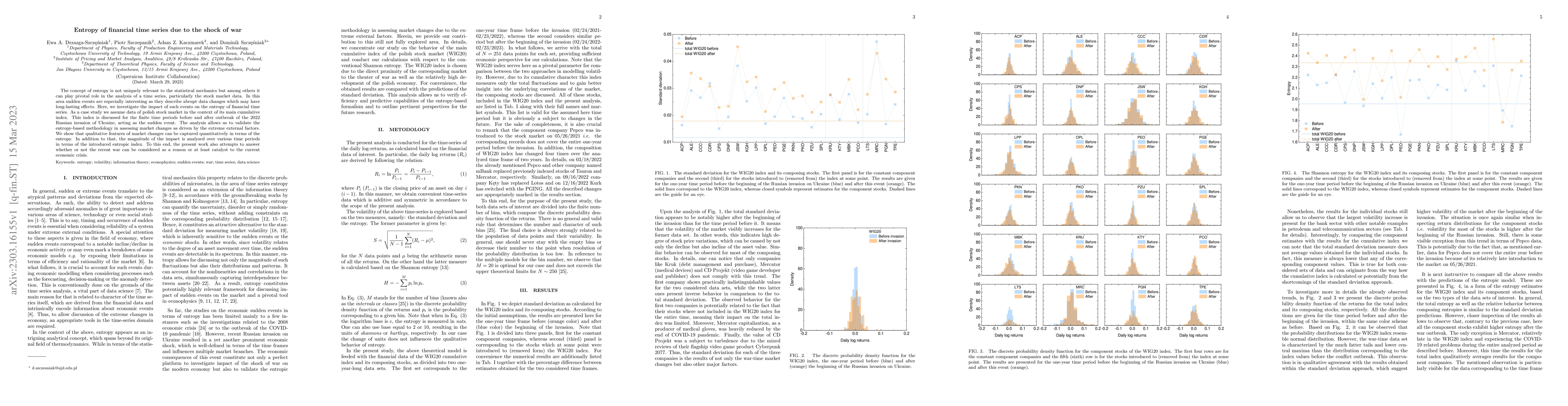

The concept of entropy is not uniquely relevant to the statistical mechanics but among others it can play pivotal role in the analysis of a time series, particularly the stock market data. In this area sudden events are especially interesting as they describe abrupt data changes which may have long-lasting effects. Here, we investigate the impact of such events on the entropy of financial time series. As a case study we assume data of polish stock market in the context of its main cumulative index. This index is discussed for the finite time periods before and after outbreak of the 2022 Russian invasion of Ukraine, acting as the sudden event. The analysis allows us to validate the entropy-based methodology in assessing market changes as driven by the extreme external factors. We show that qualitative features of market changes can be captured quantitatively in terms of the entropy. In addition to that, the magnitude of the impact is analysed over various time periods in terms of the introduced entropic index. To this end, the present work also attempts to answer whether or not the recent war can be considered as a reason or at least catalyst to the current economic crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComplexity of Financial Time Series: Multifractal and Multiscale Entropy Analyses

Farhad Shahbazi, Mohammad Sharifi, Oday Masoudi

| Title | Authors | Year | Actions |

|---|

Comments (0)