Authors

Summary

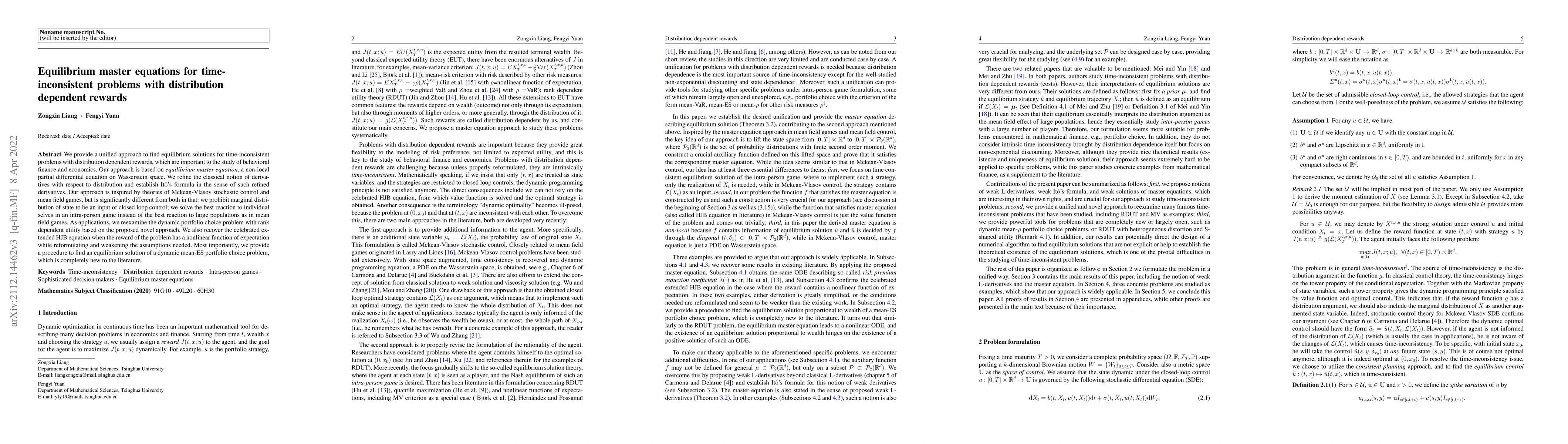

We provide a unified approach to find equilibrium solutions for time-inconsistent problems with distribution dependent rewards, which are important to the study of behavioral finance and economics. Our approach is based on {\it equilibrium master equation}, a non-local partial differential equation on Wasserstein space. We refine the classical notion of derivatives with respect to distribution and establish It$\hato$'s formula in the sense of such refined derivatives. Our approach is inspired by theories of Mckean-Vlasov stochastic control and mean field games, but is significantly different from both in that: we prohibit marginal distribution of state to be an input of closed loop control; we solve the best reaction to individual selves in an intra-person game instead of the best reaction to large populations as in mean field games. As applications, we reexamine the dynamic portfolio choice problem with rank dependent utility based on the proposed novel approach. We also recover the celebrated extended HJB equation when the reward of the problem has a nonlinear function of expectation while reformulating and weakening the assumptions needed. Most importantly, we provide a procedure to find an equilibrium solution of a dynamic mean-ES portfolio choice problem, which is completely new to the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSubgame-perfect equilibrium strategies for time-inconsistent recursive stochastic control problems

Elisa Mastrogiacomo, Marco Tarsia

No citations found for this paper.

Comments (0)