Fengyi Yuan

11 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Optimal consumption under loss-averse multiplicative habit-formation preferences

This paper studies a loss-averse version of the multiplicative habit formation preference and the corresponding optimal investment and consumption strategies over an infinite horizon. The agent's co...

Dynamic portfolio selection under generalized disappointment aversion

This paper addresses the continuous-time portfolio selection problem under generalized disappointment aversion (GDA). The implicit definition of the certainty equivalent within GDA preferences intro...

Dynamic portfolio selection for nonlinear law-dependent preferences

This paper addresses the portfolio selection problem for nonlinear law-dependent preferences in continuous time, which inherently exhibit time inconsistency. Employing the method of stochastic maxim...

Time-inconsistent mean-field stopping problems: A regularized equilibrium approach

This paper studies the mean-field Markov decision process (MDP) with the centralized stopping under the non-exponential discount. The problem differs fundamentally from most existing studies on mean...

Equilibria for Time-inconsistent Singular Control Problems

We study a time-inconsistent singular control problem originating from irreversible reinsurance decisions with non-exponential discount. A novel definition of equilibrium for time-inconsistent singu...

Consumption-investment decisions with endogenous reference point and drawdown constraint

We propose a consumption-investment decision model where past consumption peak $h$ plays a crucial role. There are two important consumption levels: the lowest constrained level and a reference leve...

Equilibrium master equations for time-inconsistent problems with distribution dependent rewards

We provide a unified approach to find equilibrium solutions for time-inconsistent problems with distribution dependent rewards, which are important to the study of behavioral finance and economics. ...

Weak equilibria for time-inconsistent control: with applications to investment-withdrawal decisions

This paper considers time-inconsistent problems when control and stopping strategies are required to be made simultaneously (called stopping control problems by us). We first formulate the timeincon...

Retirement decision with addictive habit persistence in a jump diffusion market

This paper investigates the optimal retirement decision, investment, and consumption strategies in a market with jump diffusion, taking into account habit persistence and stock-wage correlation. Our...

Unified continuous-time q-learning for mean-field game and mean-field control problems

This paper studies the continuous-time q-learning in the mean-field jump-diffusion models from the representative agent's perspective. To overcome the challenge when the population distribution may no...

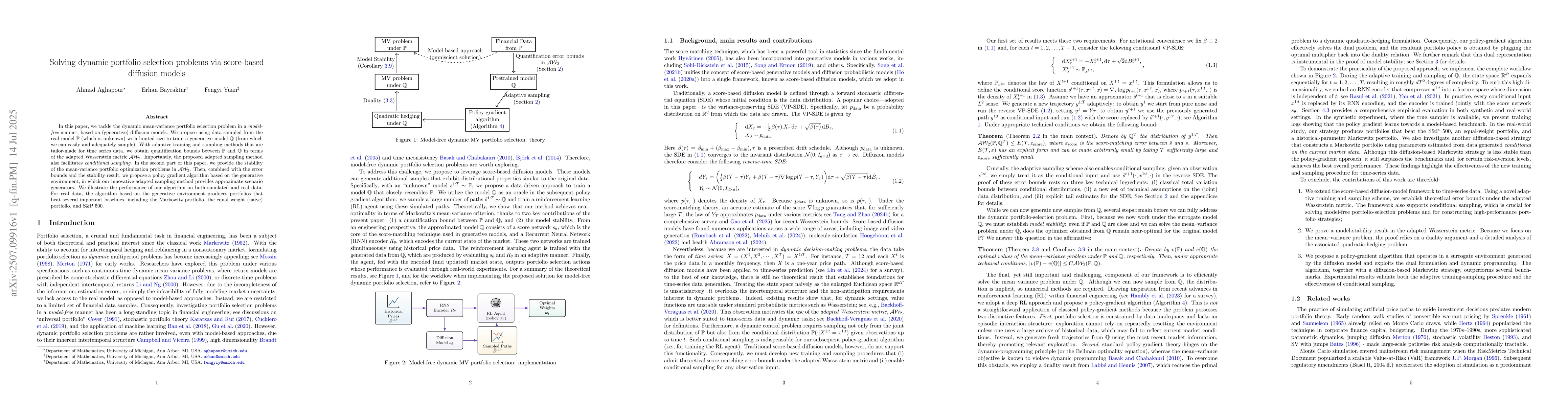

Solving dynamic portfolio selection problems via score-based diffusion models

In this paper, we tackle the dynamic mean-variance portfolio selection problem in a {\it model-free} manner, based on (generative) diffusion models. We propose using data sampled from the real model $...