Authors

Summary

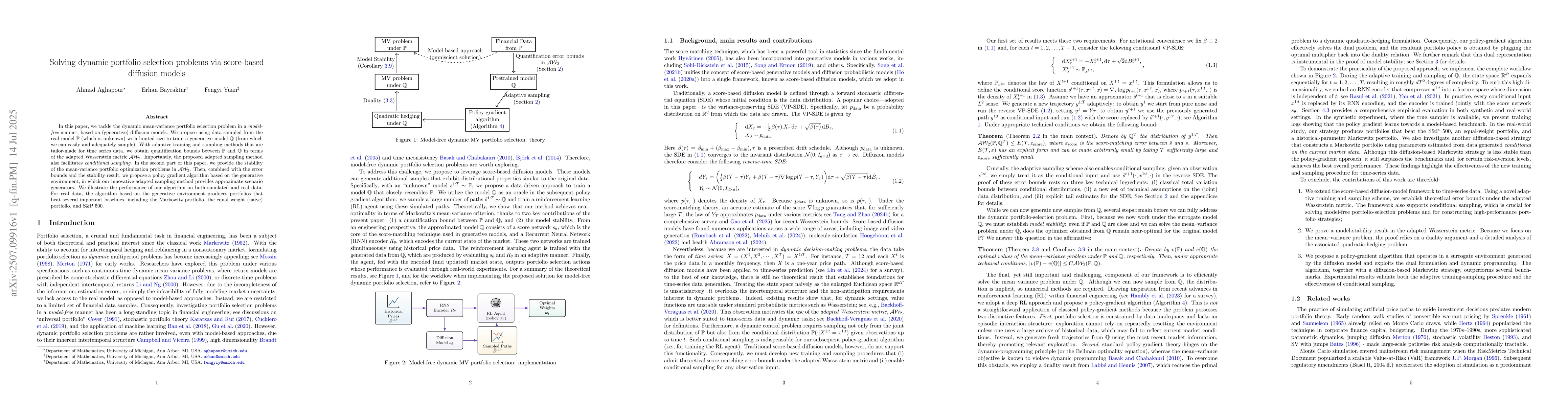

In this paper, we tackle the dynamic mean-variance portfolio selection problem in a {\it model-free} manner, based on (generative) diffusion models. We propose using data sampled from the real model $\mathcal P$ (which is unknown) with limited size to train a generative model $\mathcal Q$ (from which we can easily and adequately sample). With adaptive training and sampling methods that are tailor-made for time series data, we obtain quantification bounds between $\mathcal P$ and $\mathcal Q$ in terms of the adapted Wasserstein metric $\mathcal A W_2$. Importantly, the proposed adapted sampling method also facilitates {\it conditional sampling}. In the second part of this paper, we provide the stability of the mean-variance portfolio optimization problems in $\mathcal A W _2$. Then, combined with the error bounds and the stability result, we propose a policy gradient algorithm based on the generative environment, in which our innovative adapted sampling method provides approximate scenario generators. We illustrate the performance of our algorithm on both simulated and real data. For real data, the algorithm based on the generative environment produces portfolios that beat several important baselines, including the Markowitz portfolio, the equal weight (naive) portfolio, and S\&P 500.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConditional score-based diffusion models for solving inverse problems in mechanics

Agnimitra Dasgupta, Harisankar Ramaswamy, Javier Murgoitio Esandi et al.

Learning Image Priors through Patch-based Diffusion Models for Solving Inverse Problems

Xiaojian Xu, Bowen Song, Liyue Shen et al.

Cone-constrained Monotone Mean-Variance Portfolio Selection Under Diffusion Models

Yang Shen, Bin Zou

Solving Inverse Problems with Latent Diffusion Models via Hard Data Consistency

Zecheng Zhang, Bowen Song, Liyue Shen et al.

No citations found for this paper.

Comments (0)