Summary

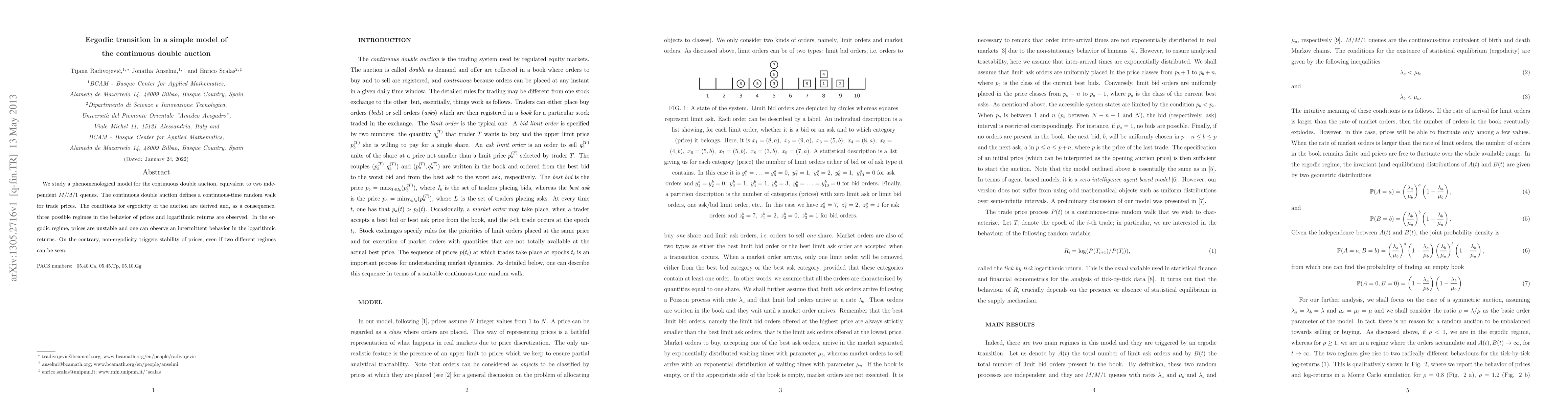

We study a phenomenological model for the continuous double auction, equivalent to two independent $M/M/1$ queues. The continuous double auction defines a continuous-time random walk for trade prices. The conditions for ergodicity of the auction are derived and, as a consequence, three possible regimes in the behavior of prices and logarithmic returns are observed. In the ergodic regime, prices are unstable and one can observe an intermittent behavior in the logarithmic returns. On the contrary, non-ergodicity triggers stability of prices, even if two different regimes can be seen.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)