Summary

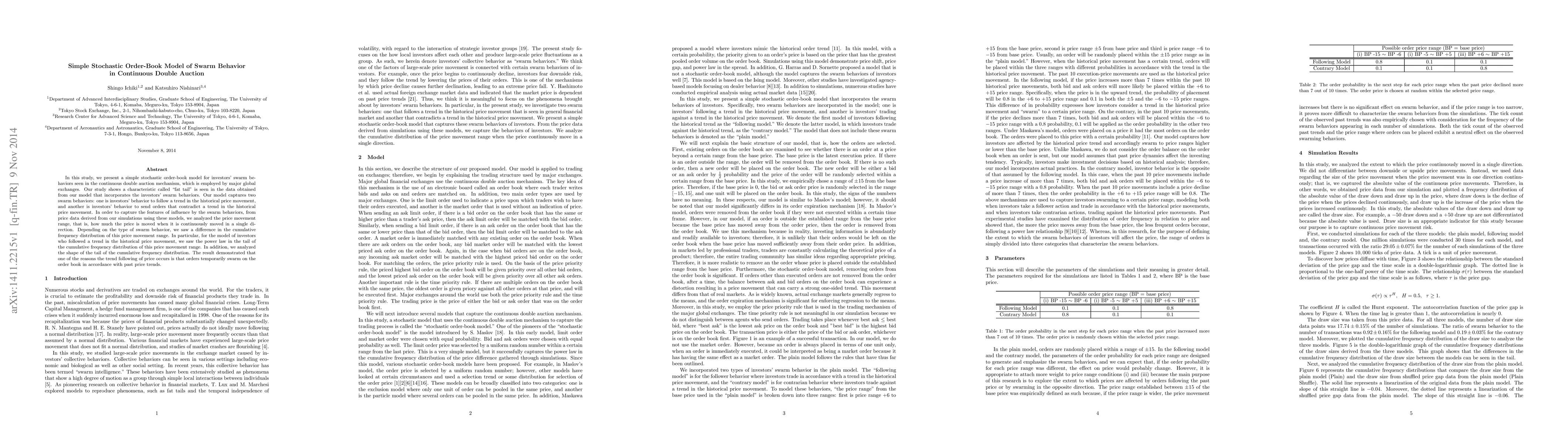

In this study, we present a simple stochastic order-book model for investors' swarm behaviors seen in the continuous double auction mechanism, which is employed by major global exchanges. Our study shows a characteristic called "fat tail" is seen in the data obtained from our model that incorporates the investors' swarm behaviors. Our model captures two swarm behaviors: one is investors' behavior to follow a trend in the historical price movement, and another is investors' behavior to send orders that contradict a trend in the historical price movement. In order to capture the features of influence by the swarm behaviors, from price data derived from our simulations using these models, we analyzed the price movement range, that is, how much the price is moved when it is continuously moved in a single direction. Depending on the type of swarm behavior, we saw a difference in the cumulative frequency distribution of this price movement range. In particular, for the model of investors who followed a trend in the historical price movement, we saw the power law in the tail of the cumulative frequency distribution of this price movement range. In addition, we analyzed the shape of the tail of the cumulative frequency distribution. The result demonstrated that one of the reasons the trend following of price occurs is that orders temporarily swarm on the order book in accordance with past price trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)