Summary

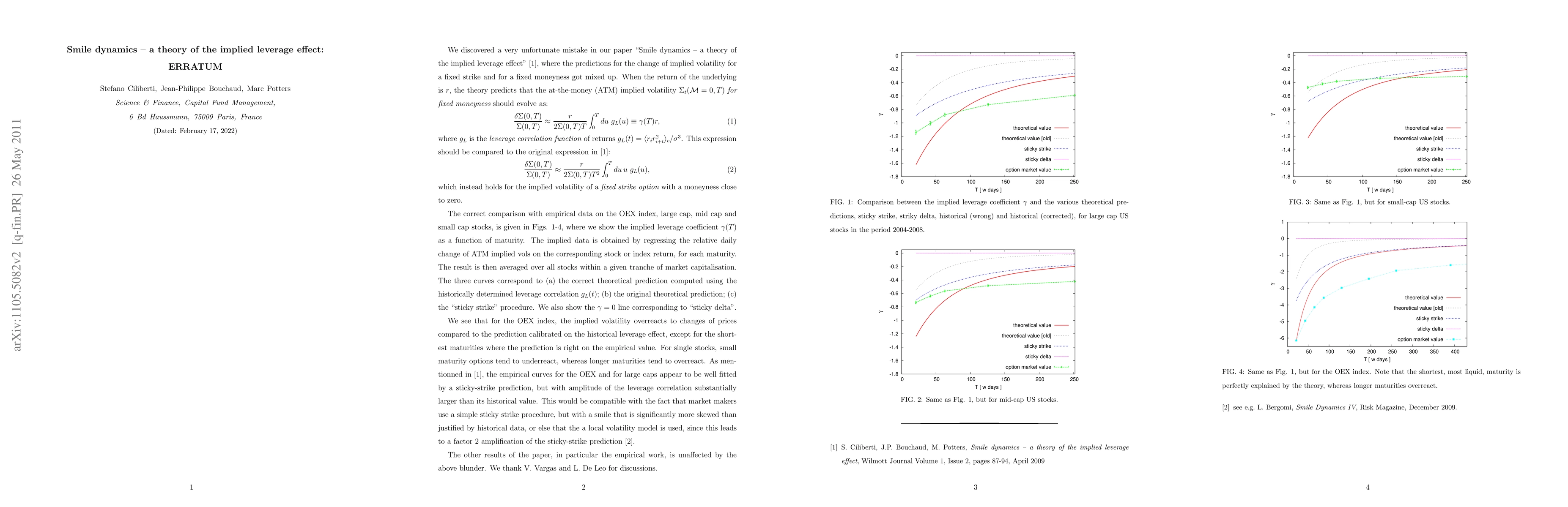

We correct a mistake in the published version of our paper. Our new conclusion is that the "implied leverage effect" for single stocks is underestimated by option markets for short maturities and overestimated for long maturities, while it is always overestimated for OEX options, except for the shortest maturities where the revised theory and data match perfectly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No citations found for this paper.

Comments (0)