Summary

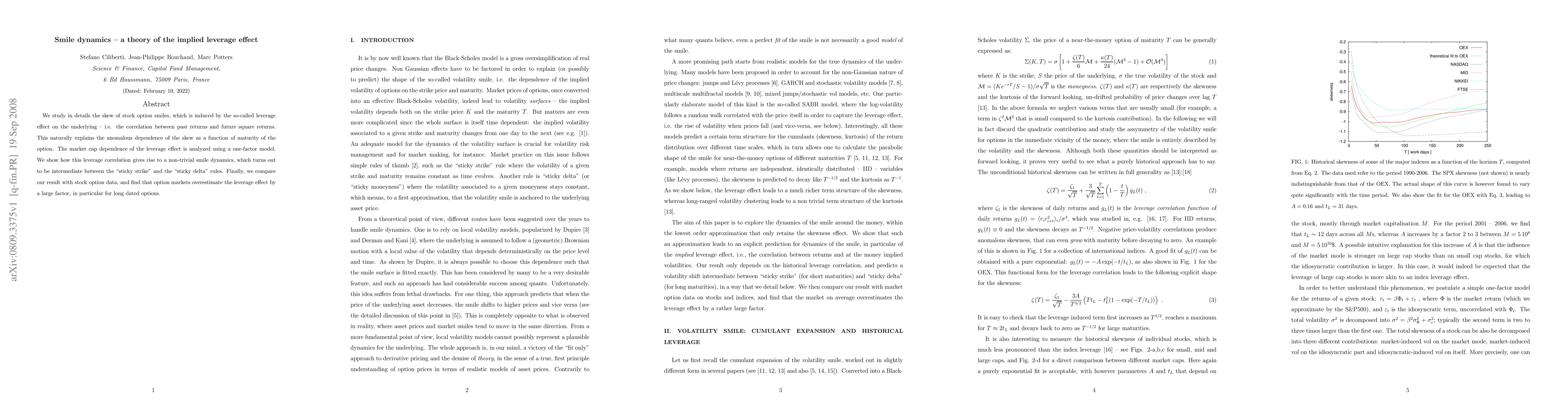

We study in details the skew of stock option smiles, which is induced by the so-called leverage effect on the underlying -- i.e. the correlation between past returns and future square returns. This naturally explains the anomalous dependence of the skew as a function of maturity of the option. The market cap dependence of the leverage effect is analyzed using a one-factor model. We show how this leverage correlation gives rise to a non-trivial smile dynamics, which turns out to be intermediate between the "sticky strike" and the "sticky delta" rules. Finally, we compare our result with stock option data, and find that option markets overestimate the leverage effect by a large factor, in particular for long dated options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

| Title | Authors | Year | Actions |

|---|

Comments (0)