Summary

We provide a bound for the error committed when using a Fourier method to price European options when the underlying follows an exponential \levy dynamic. The price of the option is described by a partial integro-differential equation (PIDE). Applying a Fourier transformation to the PIDE yields an ordinary differential equation that can be solved analytically in terms of the characteristic exponent of the \levy process. Then, a numerical inverse Fourier transform allows us to obtain the option price. We present a novel bound for the error and use this bound to set the parameters for the numerical method. We analyse the properties of the bound for a dissipative and pure-jump example. The bound presented is independent of the asymptotic behaviour of option prices at extreme asset prices. The error bound can be decomposed into a product of terms resulting from the dynamics and the option payoff, respectively. The analysis is supplemented by numerical examples that demonstrate results comparable to and superior to the existing literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

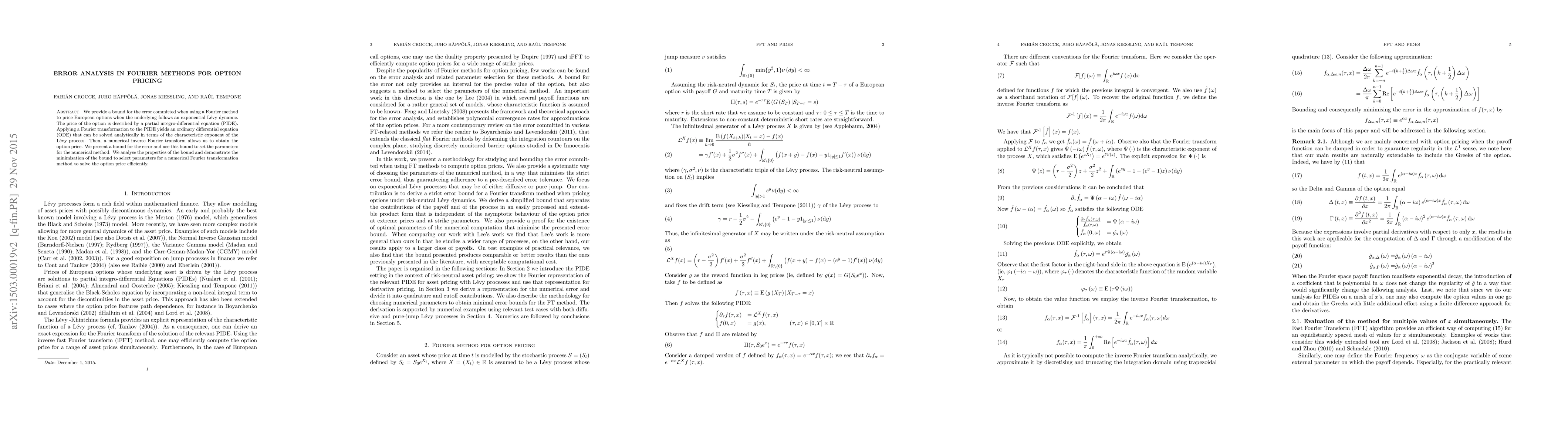

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Machine Learning methods for Fourier-based distribution estimation with application in option pricing

Álvaro Leitao, Carlos Vázquez, Fernando Alonso

| Title | Authors | Year | Actions |

|---|

Comments (0)