Authors

Summary

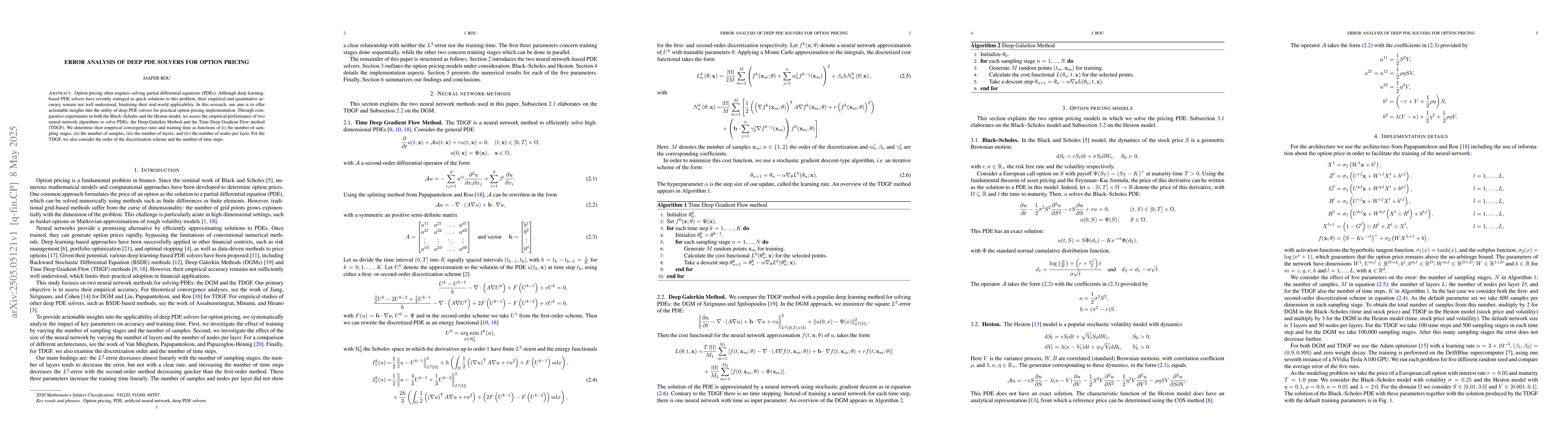

Option pricing often requires solving partial differential equations (PDEs). Although deep learning-based PDE solvers have recently emerged as quick solutions to this problem, their empirical and quantitative accuracy remain not well understood, hindering their real-world applicability. In this research, our aim is to offer actionable insights into the utility of deep PDE solvers for practical option pricing implementation. Through comparative experiments in both the Black--Scholes and the Heston model, we assess the empirical performance of two neural network algorithms to solve PDEs: the Deep Galerkin Method and the Time Deep Gradient Flow method (TDGF). We determine their empirical convergence rates and training time as functions of (i) the number of sampling stages, (ii) the number of samples, (iii) the number of layers, and (iv) the number of nodes per layer. For the TDGF, we also consider the order of the discretization scheme and the number of time steps.

AI Key Findings

Generated May 24, 2025

Methodology

The research employs comparative experiments using the Deep Galerkin Method and the Time Deep Gradient Flow method (TDGF) to assess their performance in solving PDEs for option pricing in both Black-Scholes and Heston models. It examines convergence rates and training times as functions of various parameters including sampling stages, samples, layers, nodes per layer, discretization scheme order, and time steps.

Key Results

- Determined empirical convergence rates and training time for both Deep Galerkin Method and TDGF as functions of specified parameters.

- Identified factors influencing the efficiency and accuracy of deep PDE solvers for option pricing.

Significance

This research offers actionable insights into the practical applicability of deep learning-based PDE solvers for option pricing, addressing the lack of empirical and quantitative accuracy understanding in existing methods.

Technical Contribution

Provided a detailed error analysis of deep PDE solvers, specifically the Deep Galerkin Method and TDGF, for option pricing, including their convergence rates and training time dependencies.

Novelty

This work is notable for systematically analyzing the empirical performance of deep learning-based PDE solvers, offering a comprehensive understanding crucial for their practical implementation in finance.

Limitations

- The study is limited to two neural network algorithms and two specific option pricing models.

- Results may not generalize to other PDEs or complex financial models without further investigation.

Future Work

- Explore the applicability of these methods to a broader range of PDEs and financial models.

- Investigate the performance of additional neural network architectures for PDE solving in finance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersError Analysis of Option Pricing via Deep PDE Solvers: Empirical Study

Masanori Hirano, Rawin Assabumrungrat, Kentaro Minami

Towards Fast Option Pricing PDE Solvers Powered by PIELM

Vikas Dwivedi, Balaji Srinivasan, Akshay Govind Srinivasan et al.

No citations found for this paper.

Comments (0)