Authors

Summary

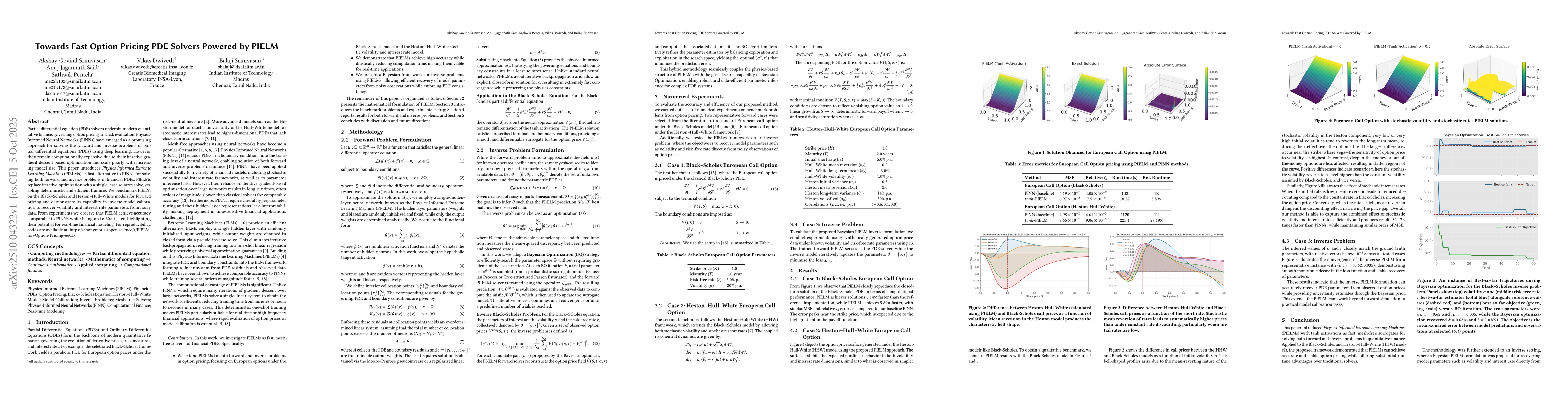

Partial differential equation (PDE) solvers underpin modern quantitative finance, governing option pricing and risk evaluation. Physics-Informed Neural Networks (PINNs) have emerged as a promising approach for solving the forward and inverse problems of partial differential equations (PDEs) using deep learning. However they remain computationally expensive due to their iterative gradient descent based optimization and scale poorly with increasing model size. This paper introduces Physics-Informed Extreme Learning Machines (PIELMs) as fast alternative to PINNs for solving both forward and inverse problems in financial PDEs. PIELMs replace iterative optimization with a single least-squares solve, enabling deterministic and efficient training. We benchmark PIELM on the Black-Scholes and Heston-Hull-White models for forward pricing and demonstrate its capability in inverse model calibration to recover volatility and interest rate parameters from noisy data. From experiments we observe that PIELM achieve accuracy comparable to PINNs while being up to $30\times$ faster, highlighting their potential for real-time financial modeling.

AI Key Findings

Generated Oct 11, 2025

Methodology

The paper introduces Physics-Informed Extreme Learning Machines (PIELMs) as a fast alternative to Physics-Informed Neural Networks (PINNs) for solving forward and inverse problems in financial PDEs. PIELMs use a single least-squares solve instead of iterative gradient descent optimization, enabling deterministic and efficient training.

Key Results

- PIELMs achieve accuracy comparable to PINNs while being up to 30× faster in solving forward pricing problems.

- PIELMs successfully recover volatility and interest rate parameters from noisy data in inverse model calibration.

- The method demonstrates 32.17× faster performance than PINNs for Heston-Hull-White models while maintaining similar MSE.

Significance

This research provides a computationally efficient framework for real-time financial modeling and risk evaluation by combining physics-informed learning with fast numerical solvers, which is critical for high-frequency trading and complex derivative pricing.

Technical Contribution

The paper proposes a novel physics-informed machine learning framework that replaces iterative optimization with a single analytical solution, enabling efficient and accurate numerical solutions to PDEs in finance.

Novelty

PIELMs introduce a deterministic, closed-form solution approach for PDEs in finance, contrasting with traditional iterative PINN methods, and enable efficient parameter inference through Bayesian optimization for inverse problems.

Limitations

- The paper focuses primarily on European call options and specific volatility/interest rate models, limiting generalizability to other financial instruments.

- The Bayesian optimization approach for inverse problems may require significant computational resources for large-scale parameter spaces.

Future Work

- Exploring adaptive basis placement for improved accuracy in complex PDE systems.

- Extending the framework to nonlinear or free-boundary PDEs like American options using curriculum learning.

- Investigating hybrid global-local activation functions for better performance in multi-dimensional financial models.

Paper Details

PDF Preview

Similar Papers

Found 4 papersError Analysis of Option Pricing via Deep PDE Solvers: Empirical Study

Masanori Hirano, Rawin Assabumrungrat, Kentaro Minami

Machine Learning-powered Pricing of the Multidimensional Passport Option

Josef Teichmann, Hanna Wutte

Comments (0)