Authors

Summary

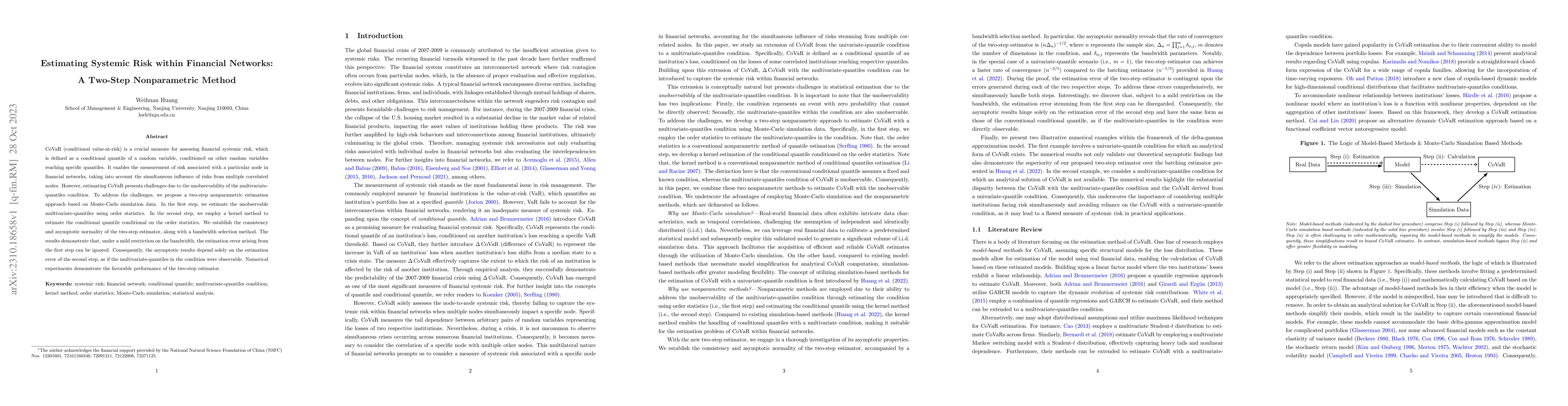

CoVaR (conditional value-at-risk) is a crucial measure for assessing financial systemic risk, which is defined as a conditional quantile of a random variable, conditioned on other random variables reaching specific quantiles. It enables the measurement of risk associated with a particular node in financial networks, taking into account the simultaneous influence of risks from multiple correlated nodes. However, estimating CoVaR presents challenges due to the unobservability of the multivariate-quantiles condition. To address the challenges, we propose a two-step nonparametric estimation approach based on Monte-Carlo simulation data. In the first step, we estimate the unobservable multivariate-quantiles using order statistics. In the second step, we employ a kernel method to estimate the conditional quantile conditional on the order statistics. We establish the consistency and asymptotic normality of the two-step estimator, along with a bandwidth selection method. The results demonstrate that, under a mild restriction on the bandwidth, the estimation error arising from the first step can be ignored. Consequently, the asymptotic results depend solely on the estimation error of the second step, as if the multivariate-quantiles in the condition were observable. Numerical experiments demonstrate the favorable performance of the two-step estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)