Summary

We consider the problem of estimating the roughness of the volatility in a stochastic volatility model that arises as a nonlinear function of fractional Brownian motion with drift. To this end, we introduce a new estimator that measures the so-called roughness exponent of a continuous trajectory, based on discrete observations of its antiderivative. We provide conditions on the underlying trajectory under which our estimator converges in a strictly pathwise sense. Then we verify that these conditions are satisfied by almost every sample path of fractional Brownian motion (with drift). As a consequence, we obtain strong consistency theorems in the context of a large class of rough volatility models. Numerical simulations show that our estimation procedure performs well after passing to a scale-invariant modification of our estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

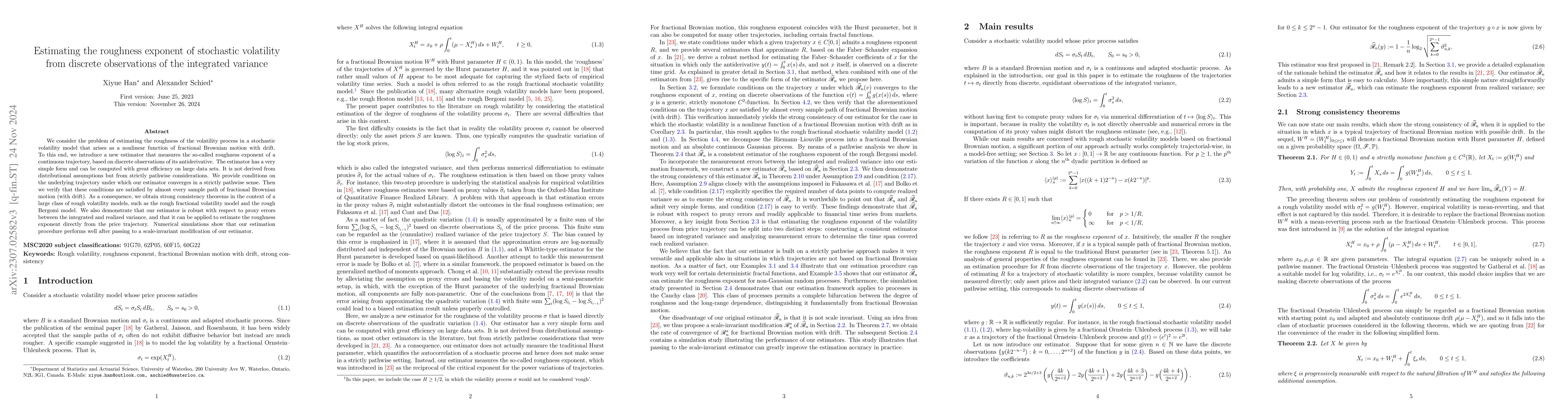

PDF Preview

Key Terms

Similar Papers

Found 4 papersA GMM approach to estimate the roughness of stochastic volatility

Kim Christensen, Bezirgen Veliyev, Mikko S. Pakkanen et al.

Short-maturity options on realized variance in local-stochastic volatility models

Xiaoyu Wang, Dan Pirjol, Lingjiong Zhu

Roughness Analysis of Realized Volatility and VIX through Randomized Kolmogorov-Smirnov Distribution

Daniele Angelini, Sergio Bianchi

No citations found for this paper.

Comments (0)