Summary

We develop a GMM approach for estimation of log-normal stochastic volatility models driven by a fractional Brownian motion with unrestricted Hurst exponent. We show that a parameter estimator based on the integrated variance is consistent and, under stronger conditions, asymptotically normally distributed. We inspect the behavior of our procedure when integrated variance is replaced with a noisy measure of volatility calculated from discrete high-frequency data. The realized estimator contains sampling error, which skews the fractal coefficient toward "illusive roughness." We construct an analytical approach to control the impact of measurement error without introducing nuisance parameters. In a simulation study, we demonstrate convincing small sample properties of our approach based both on integrated and realized variance over the entire memory spectrum. We show the bias correction attenuates any systematic deviance in the parameter estimates. Our procedure is applied to empirical high-frequency data from numerous leading equity indexes. With our robust approach the Hurst index is estimated around 0.05, confirming roughness in stochastic volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

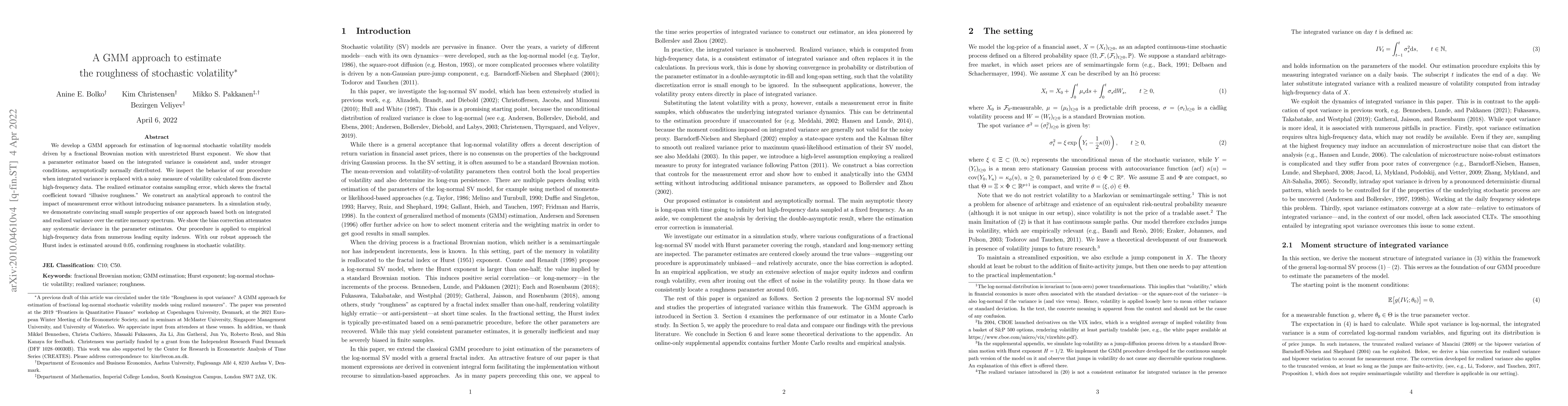

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)