Authors

Summary

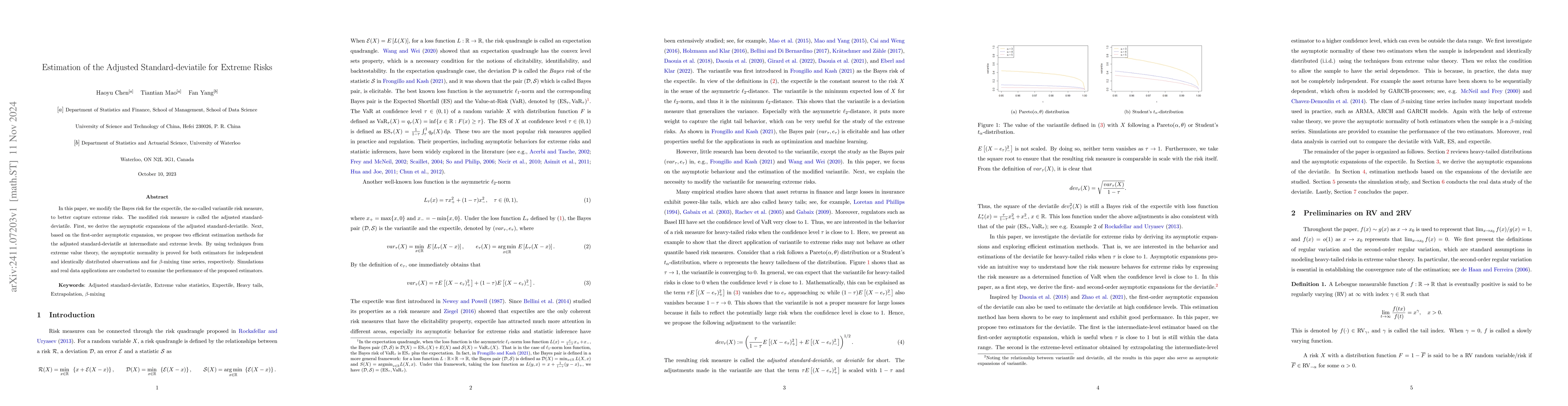

In this paper, we modify the Bayes risk for the expectile, the so-called variantile risk measure, to better capture extreme risks. The modified risk measure is called the adjusted standard-deviatile. First, we derive the asymptotic expansions of the adjusted standard-deviatile. Next, based on the first-order asymptotic expansion, we propose two efficient estimation methods for the adjusted standard-deviatile at intermediate and extreme levels. By using techniques from extreme value theory, the asymptotic normality is proved for both estimators. Simulations and real data applications are conducted to examine the performance of the proposed estimators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Estimation in Extreme Value Regression Models of Hedge Fund Tail Risks

Marie Kratz, Julien Hambuckers, Antoine Usseglio-Carleve

Model evaluation for extreme risks

Yoshua Bengio, Markus Anderljung, Nahema Marchal et al.

Extreme Limit Theory of Competing Risks under Power Normalization

Kai Wang, Kaihao Hu, Corina Constantinescu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)