Summary

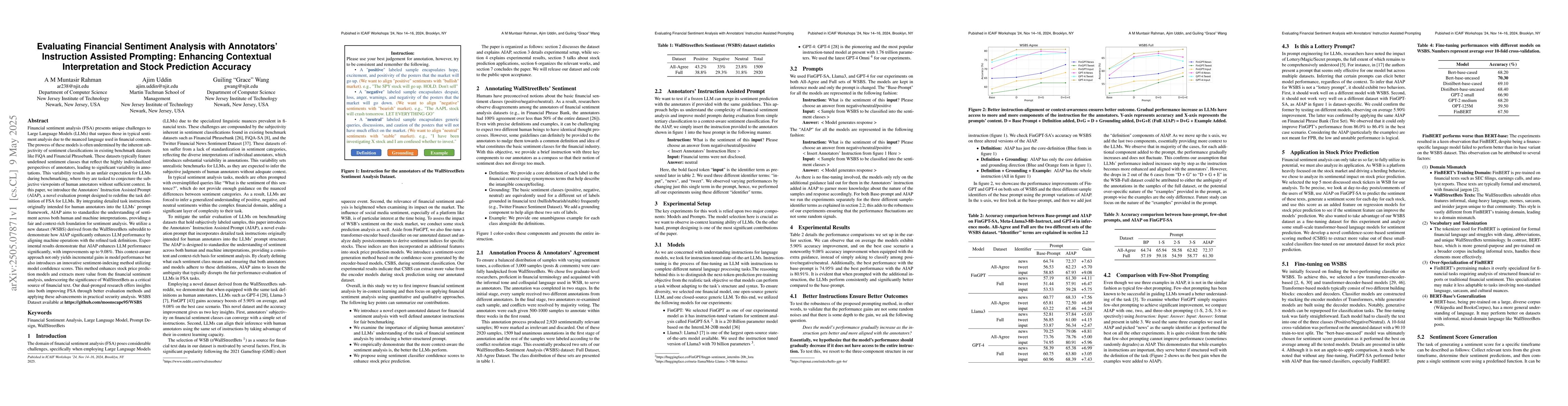

Financial sentiment analysis (FSA) presents unique challenges to LLMs that surpass those in typical sentiment analysis due to the nuanced language used in financial contexts. The prowess of these models is often undermined by the inherent subjectivity of sentiment classifications in existing benchmark datasets like Financial Phrasebank. These datasets typically feature undefined sentiment classes that reflect the highly individualized perspectives of annotators, leading to significant variability in annotations. This variability results in an unfair expectation for LLMs during benchmarking, where they are tasked to conjecture the subjective viewpoints of human annotators without sufficient context. In this paper, we introduce the Annotators' Instruction Assisted Prompt, a novel evaluation prompt designed to redefine the task definition of FSA for LLMs. By integrating detailed task instructions originally intended for human annotators into the LLMs' prompt framework, AIAP aims to standardize the understanding of sentiment across both human and machine interpretations, providing a fair and context-rich foundation for sentiment analysis. We utilize a new dataset, WSBS, derived from the WallStreetBets subreddit to demonstrate how AIAP significantly enhances LLM performance by aligning machine operations with the refined task definitions. Experimental results demonstrate that AIAP enhances LLM performance significantly, with improvements up to 9.08. This context-aware approach not only yields incremental gains in performance but also introduces an innovative sentiment-indexing method utilizing model confidence scores. This method enhances stock price prediction models and extracts more value from the financial sentiment analysis, underscoring the significance of WSB as a critical source of financial text. Our research offers insights into both improving FSA through better evaluation methods.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research introduces Annotators' Instruction Assisted Prompt (AIAP), a novel evaluation prompt designed to standardize sentiment interpretation for LLMs by incorporating detailed task instructions meant for human annotators into the prompt framework.

Key Results

- AIAP significantly enhances LLM performance in financial sentiment analysis, with improvements up to 9.08.

- AIAP introduces an innovative sentiment-indexing method using model confidence scores, which enhances stock price prediction models.

Significance

This research offers insights into improving Financial Sentiment Analysis (FSA) through better evaluation methods, highlighting the importance of context-rich foundation for sentiment analysis and the value of WallStreetBets (WSB) as a critical source of financial text.

Technical Contribution

The development and application of Annotators' Instruction Assisted Prompt (AIAP) for enhancing contextual interpretation and stock prediction accuracy in financial sentiment analysis.

Novelty

AIAP's unique approach of integrating annotator instructions into the prompt framework for LLMs sets it apart, offering a standardized method for aligning human and machine sentiment interpretations in FSA.

Limitations

- The study is limited to the WSBS dataset derived from WallStreetBets subreddit.

- Generalizability of AIAP to other financial text sources or domains beyond stock prediction remains to be explored.

Future Work

- Investigate the applicability of AIAP across various financial text datasets and domains.

- Explore the integration of AIAP with other NLP techniques for improved FSA performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinGPT: Enhancing Sentiment-Based Stock Movement Prediction with Dissemination-Aware and Context-Enriched LLMs

Hongyang Yang, Boyu Zhang, Christina Dan Wang et al.

SARF: Enhancing Stock Market Prediction with Sentiment-Augmented Random Forest

Saber Talazadeh, Dragan Perakovic

Contextual Sentence Analysis for the Sentiment Prediction on Financial Data

Elvys Linhares Pontes, Mohamed Benjannet

Analogy-Driven Financial Chain-of-Thought (AD-FCoT): A Prompting Approach for Financial Sentiment Analysis

Anmol Singhal Navya Singhal

No citations found for this paper.

Comments (0)