Summary

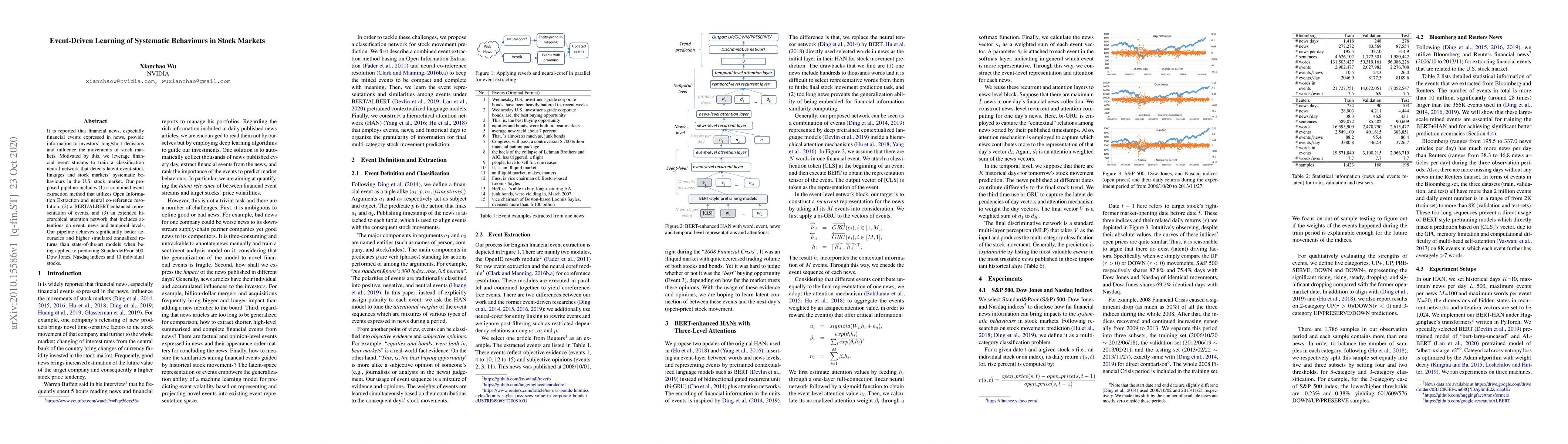

It is reported that financial news, especially financial events expressed in news, provide information to investors' long/short decisions and influence the movements of stock markets. Motivated by this, we leverage financial event streams to train a classification neural network that detects latent event-stock linkages and stock markets' systematic behaviours in the U.S. stock market. Our proposed pipeline includes (1) a combined event extraction method that utilizes Open Information Extraction and neural co-reference resolution, (2) a BERT/ALBERT enhanced representation of events, and (3) an extended hierarchical attention network that includes attentions on event, news and temporal levels. Our pipeline achieves significantly better accuracies and higher simulated annualized returns than state-of-the-art models when being applied to predicting Standard\&Poor 500, Dow Jones, Nasdaq indices and 10 individual stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)