Summary

We revisit the classical topic of quadratic and linear mean-variance equilibria with both financial and real assets. The novelty of our results is that they are the first allowing for equilibrium prices driven by general semimartingales and hold in discrete as well as continuous time. For agents with quadratic utility functions, we provide necessary and sufficient conditions for the existence and uniqueness of equilibria. We complement our analysis by providing explicit examples showing non-uniqueness or non-existence of equilibria. We then study the more difficult case of linear mean-variance preferences. We first show that under mild assumptions, a linear mean-variance equilibrium corresponds to a quadratic equilibrium (for different preference parameters). We then use this link to study a fixed-point problem that establishes existence (and uniqueness in a suitable class) of linear mean-variance equilibria. Our results rely on fine properties of dynamic mean-variance hedging in general semimartingale markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

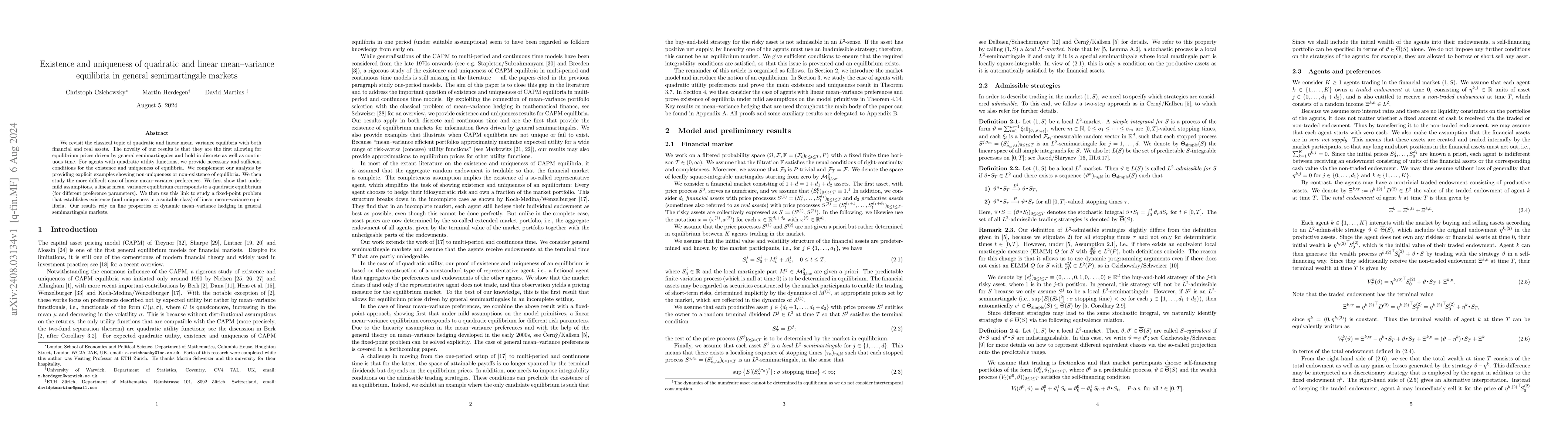

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)