Summary

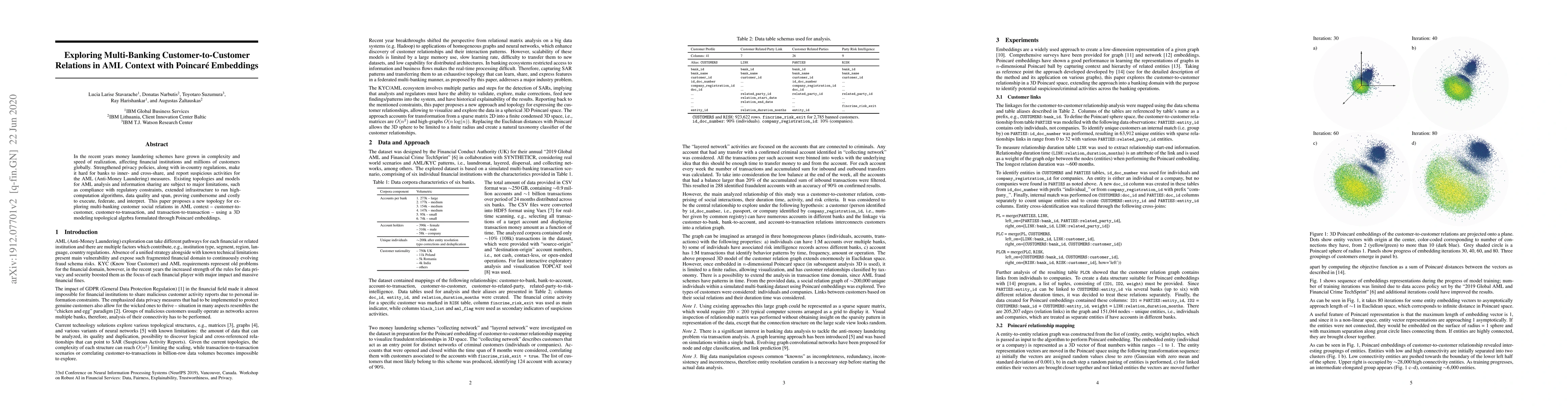

In the recent years money laundering schemes have grown in complexity and speed of realization, affecting financial institutions and millions of customers globally. Strengthened privacy policies, along with in-country regulations, make it hard for banks to inner- and cross-share, and report suspicious activities for the AML (Anti-Money Laundering) measures. Existing topologies and models for AML analysis and information sharing are subject to major limitations, such as compliance with regulatory constraints, extended infrastructure to run high-computation algorithms, data quality and span, proving cumbersome and costly to execute, federate, and interpret. This paper proposes a new topology for exploring multi-banking customer social relations in AML context -- customer-to-customer, customer-to-transaction, and transaction-to-transaction -- using a 3D modeling topological algebra formulated through Poincar\'e embeddings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling customer lifetime-value in the retail banking industry

Salvatore Mercuri, Raad Khraishi, Greig Cowan

| Title | Authors | Year | Actions |

|---|

Comments (0)