Authors

Summary

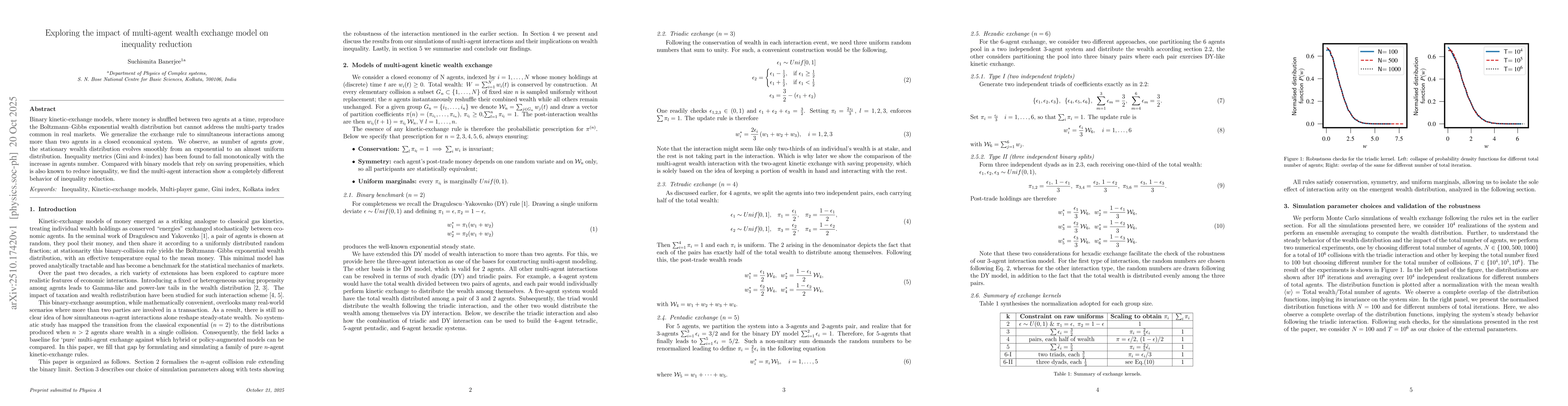

Binary kinetic exchange models, where money is shuffled between two agents at a time, reproduce the Boltzmann Gibbs exponential wealth distribution but cannot address the multi party trades common in real markets. We generalize the exchange rule to simultaneous interactions among more than two agents in a closed economical system. We observe, as number of agents grow, the stationary wealth distribution evolves smoothly from an exponential to an almost uniform distribution. Inequality metrics (Gini and k index) has been found to fall monotonically with the increase in agents number. Compared with binary models that rely on saving propensities, which is also known to reduce inequality, we find the multi agent interaction show a completely different behavior of inequality reduction.

AI Key Findings

Generated Oct 25, 2025

Methodology

The study employs Monte Carlo simulations to analyze wealth exchange dynamics in multi-agent systems, comparing triadic interactions with binary kinetic exchange models. It uses Gini and k-index metrics to quantify inequality reduction.

Key Results

- As the number of agents increases, wealth distribution transitions from exponential to nearly uniform, reducing inequality.

- Multi-agent interactions show a distinct inequality reduction pattern compared to binary models with saving propensities.

- The k-index and Gini coefficient both decrease monotonically with more agents, approaching uniform distribution limits.

Significance

This research provides insights into designing economic systems that promote equitable wealth distribution through multi-agent interactions, offering practical implications for policy-making and financial mechanisms.

Technical Contribution

Developing a triadic wealth exchange model that generalizes binary kinetic exchange to multi-agent interactions, enabling analysis of wealth distribution dynamics.

Novelty

Introduces a multi-agent interaction framework that demonstrates a fundamentally different inequality reduction mechanism compared to traditional binary exchange models with saving propensities.

Limitations

- The model assumes a closed economic system without external factors.

- It simplifies real-world market complexities like heterogeneous agent behaviors.

Future Work

- Exploring heterogeneous agent behaviors in multi-agent systems.

- Investigating the impact of multi-agent interactions in open economies with external influences.

Comments (0)