Summary

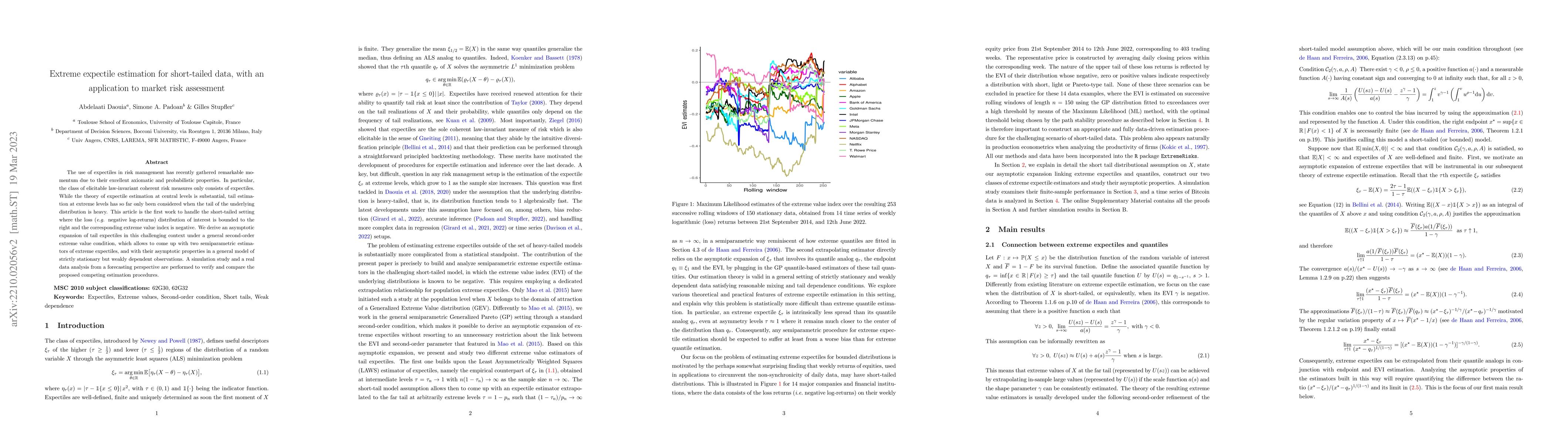

The use of expectiles in risk management has recently gathered remarkable momentum due to their excellent axiomatic and probabilistic properties. In particular, the class of elicitable law-invariant coherent risk measures only consists of expectiles. While the theory of expectile estimation at central levels is substantial, tail estimation at extreme levels has so far only been considered when the tail of the underlying distribution is heavy. This article is the first work to handle the short-tailed setting where the loss (e.g. negative log-returns) distribution of interest is bounded to the right and the corresponding extreme value index is negative. We derive an asymptotic expansion of tail expectiles in this challenging context under a general second-order extreme value condition, which allows to come up with two semiparametric estimators of extreme expectiles, and with their asymptotic properties in a general model of strictly stationary but weakly dependent observations. A simulation study and a real data analysis from a forecasting perspective are performed to verify and compare the proposed competing estimation procedures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantitative Risk Management in Volatile Markets with an Expectile-Based Framework for the FTSE Index

Abiodun Finbarrs Oketunji

Value-at-Risk- and Expectile-based Systemic Risk Measures and Second-order Asymptotics: With Applications to Diversification

Yang Liu, Bingzhen Geng, Yimiao Zhao

Moment Estimator-Based Extreme Quantile Estimation with Erroneous Observations: Application to Elliptical Extreme Quantile Region Estimation

Lauri Viitasaari, Pauliina Ilmonen, Jaakko Pere

| Title | Authors | Year | Actions |

|---|

Comments (0)