Summary

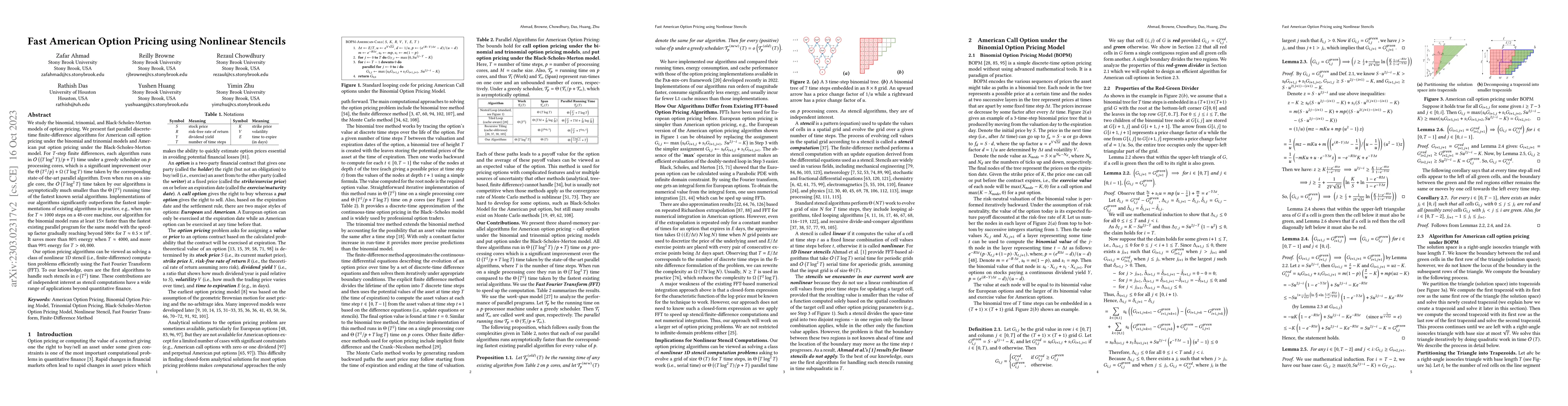

We study the binomial, trinomial, and Black-Scholes-Merton models of option pricing. We present fast parallel discrete-time finite-difference algorithms for American call option pricing under the binomial and trinomial models and American put option pricing under the Black-Scholes-Merton model. For $T$-step finite differences, each algorithm runs in $O(\left(T\log^2{T}\right)/p + T)$ time under a greedy scheduler on $p$ processing cores, which is a significant improvement over the $\Theta({T^2}/{p}) + \Omega(T\log{T})$ time taken by the corresponding state-of-the-art parallel algorithm. Even when run on a single core, the $O(T\log^2{T})$ time taken by our algorithms is asymptotically much smaller than the $\Theta(T^2)$ running time of the fastest known serial algorithms. Implementations of our algorithms significantly outperform the fastest implementations of existing algorithms in practice, e.g., when run for $T \approx 1000$ steps on a 48-core machine, our algorithm for the binomial model runs at least $15\times$ faster than the fastest existing parallel program for the same model with the speed-up factor gradually reaching beyond $500\times$ for $T \approx 0.5 \times 10^6$. It saves more than 80\% energy when $T \approx 4000$, and more than 99\% energy for $T > 60,000$. Our option pricing algorithms can be viewed as solving a class of nonlinear 1D stencil (i.e., finite-difference) computation problems efficiently using the Fast Fourier Transform (FFT). To our knowledge, ours are the first algorithms to handle such stencils in $o(T^2)$ time. These contributions are of independent interest as stencil computations have a wide range of applications beyond quantitative finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAmerican option pricing using generalised stochastic hybrid systems

Sascha Desmettre, Evelyn Buckwar, Amira Meddah et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)